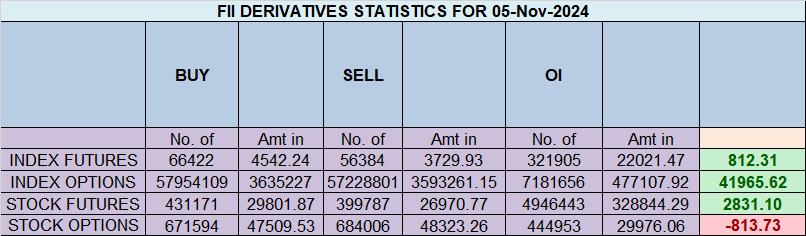

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 1800 contracts worth ₹107 crores, resulting in a increase of 8070 contracts in the net open interest. FIIs added 13847 long contracts and added 3809 short contracts, indicating a preference for adding long positions and adding short positions. With a net FII long-short ratio of 0.55, FIIs utilized the market rise to enter long positions and enter short positions in Nifty futures. Clients covered 17322 long contracts and covered 10132 short contracts. FII are holding 27% Long and 73 % Shorts in Index Futures and Clients are holding 66 % Long and 34 % Shorts in Index Futures.

May the blessings of Goddess Lakshmi shine upon you and your family this Diwali. Wishing you love, light, and joy! May the gleaming diyas of Diwali illuminate your life, bringing a year full of joy, success, and good health. May this Diwali bring you endless moments of joy, love, and success.

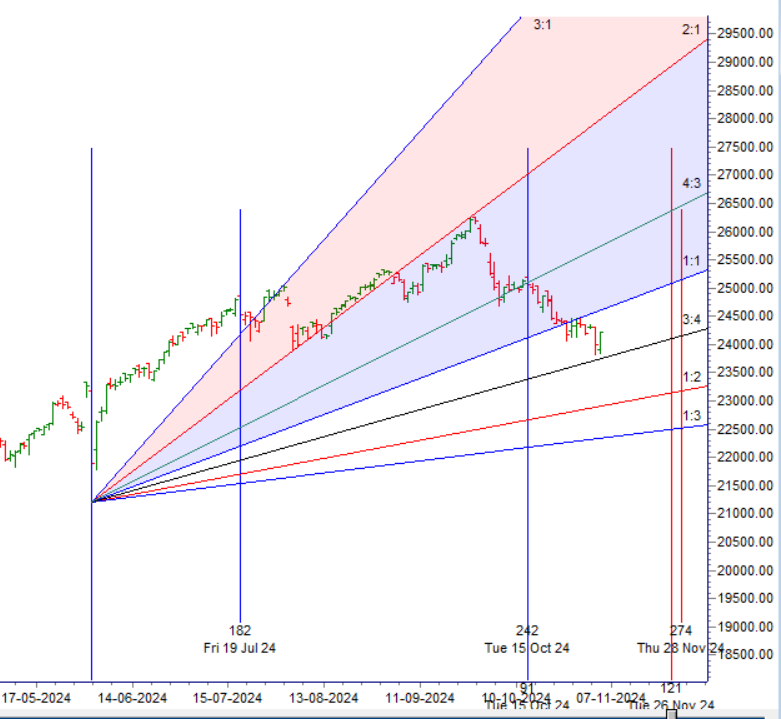

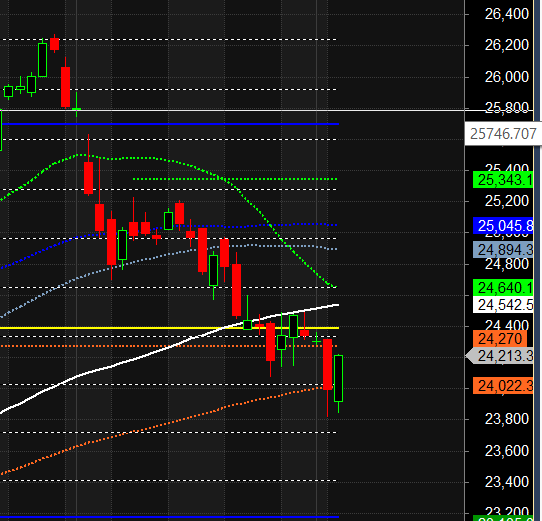

Nifty has formed a triple top as the price struggles to close above 24,500. Bayer’s Rule worked once again, as the price did not breach the 15-minute high, and dropping below the low led to a solid pullback. The price is currently facing resistance at its Gann angle, as shown below. Bulls need to hold 24251-24,270 in the event of a pullback. Bears are set to form the first lower low on the monthly chart, with the price closing below last month’s low of 24,753.

The Complete Election Day Guide: Trump vs. Kamala – An Indian Investor’s Perspective

Nifty has formed a double bottom around 23,816 and 23,842, and the price is also near the 50% retracement of the entire move from June 4 to September 27. Additionally, we have discussed the significance of Mercury and Mars changing houses astrologically, as well as the Gann time cycle, with November 3, 2009 marking a major low, indicating a confluence of Gann and astro cycles.

If election results are favorable for the market, we could witness a big short-covering rally similar to what we saw in Bank Nifty today. Trade cautiously over the next two trading sessions.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24279 for a move towards 24356/24433. Bears will get active below 24202 for a move towards 24124/24047/23970.

Traders may watch out for potential intraday reversals at 09:44,10:54,12:20,1:39,02:51 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.11 lakh cr , witnessing a addition of 2.3 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of SHORT positions today.

Nifty Advance Decline Ratio at 39:11 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25343 close below it.

Nifty closed Below its 100 SMA@24542 Trend is Buy on Dips till above 24022.

Nifty options chain shows that the maximum pain point is at 24200 and the put-call ratio (PCR) is at 0.67 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24300 strike, followed by 24500 strikes. On the put side, the highest OI is at the 24100 strike, followed by 24000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24100-24500 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 2569 crores, while Domestic Institutional Investors (DII) bought 3000 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

One Reason for Overtrading is due to an excessive flood of knowledge. Through numerous books, seminars, workshops, webinars trader acquire an incredible amount of specialist knowledge over time. There is also a large number Trading approaches of other traders that are constantly floating around in your head like a swarm of bees gone wild. Knowledge can be here quickly too Cause confusion.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24235 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24112, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24279 Tgt 24323, 24385 and 24444 ( Nifty Spot Levels)

Sell Below 24200 Tgt 24166, 24108 and 24076 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Thankyou sir for your daily updates