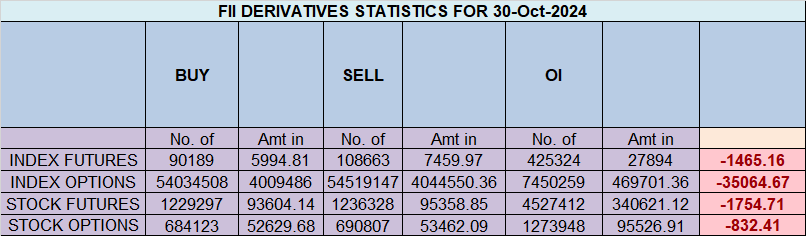

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 219 contracts worth ₹12.50crores, resulting in a decrease of 12119 contracts in the net open interest. FIIs covered 32380 long contracts and covered 1757 short contracts, indicating a preference for covering long positions and covering short positions. With a net FII long-short ratio of 0.53, FIIs utilized the market rise to exit long positions and exit short positions in Nifty futures. Clients covered 8115 long contracts and added 13057 short contracts. FII are holding 40% Long and 60 % Shorts in Index Futures and Clients are holding 64 % Long and 36 % Shorts in Index Futures.

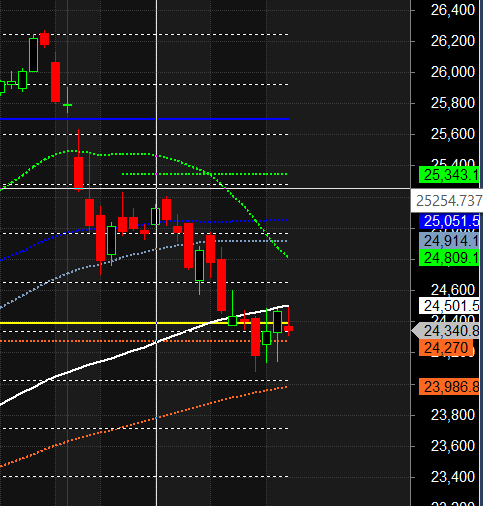

Nifty saw a strong rise today after forming a double bottom, closing at the highest point of the day. Now, bulls need a close above 24,529 to trigger a rally toward last month’s low at 24,753 in the next two trading sessions. Tomorrow, we have Bayer Rule 7: Market changes are likely when Venus or Mars reaches its Aphelion or Perihelion (Geocentric). Watch the first 15 minutes’ high and low to capture the day’s trend.

May the blessings of Goddess Lakshmi shine upon you and your family this Diwali. Wishing you love, light, and joy! May the gleaming diyas of Diwali illuminate your life, bringing a year full of joy, success, and good health. May this Diwali bring you endless moments of joy, love, and success.

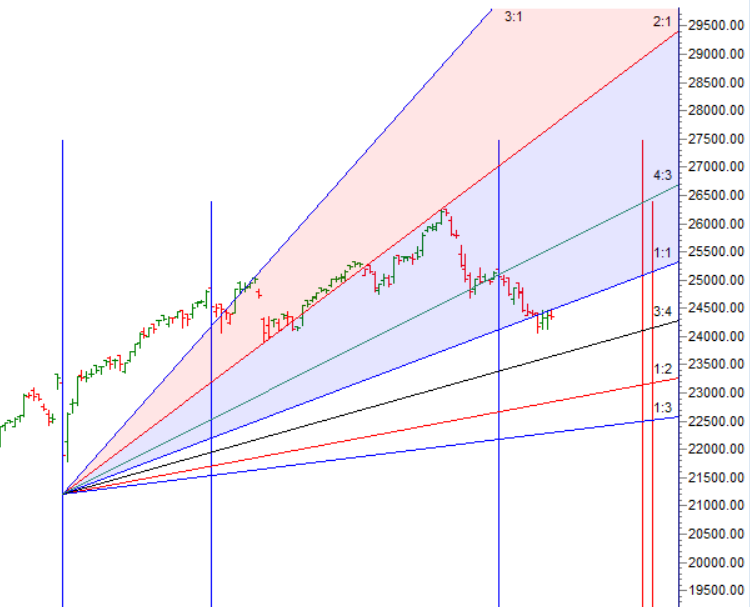

Nifty has formed a triple top as the price struggles to close above 24,500. Bayer’s Rule worked once again, as the price did not breach the 15-minute high, and dropping below the low led to a solid pullback. The price is currently facing resistance at its Gann angle, as shown below. Bulls need to hold 24251-24,270 in the event of a pullback. Bears are set to form the first lower low on the monthly chart, with the price closing below last month’s low of 24,753.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24373 for a move towards 24451/24529/24607. Bears will get active below 24296 for a move towards 24218/24140.

Traders may watch out for potential intraday reversals at 09:52,11:24,1:33,02:52 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 0.60 lakh cr , witnessing a liquidation of 22 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closure of SHORT positions today.

Nifty Advance Decline Ratio at 30:19 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25343 close below it.

Nifty closed Below its 100 SMA@24501 Trend is Buy on Dips till above 24270

Nifty options chain shows that the maximum pain point is at 24300 and the put-call ratio (PCR) is at 0.95 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

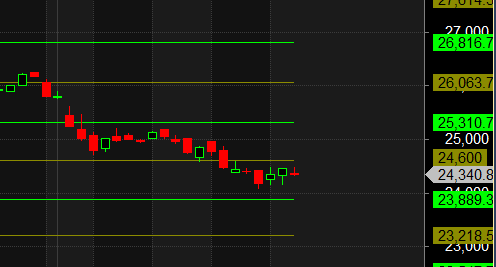

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24500 strike, followed by 24600 strikes. On the put side, the highest OI is at the 24400 strike, followed by 24300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24300-24600 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 4613 crores, while Domestic Institutional Investors (DII) bought 4518 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Trading needs Concentration and preparation. If you do it spontaneously, you will likely to be unsuccessful.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24323 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24411 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 24537

Lower End of Expiry : 24142

Nifty Intraday Trading Levels

Buy Above 24368 Tgt 24424, 24464 and 24512 ( Nifty Spot Levels)

Sell Below 24300 Tgt 24266, 24233 and 24185 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.