Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 5670 contracts with a total value of 444 crores. This activity led to a increase of 2736 contracts in the Net Open Interest.

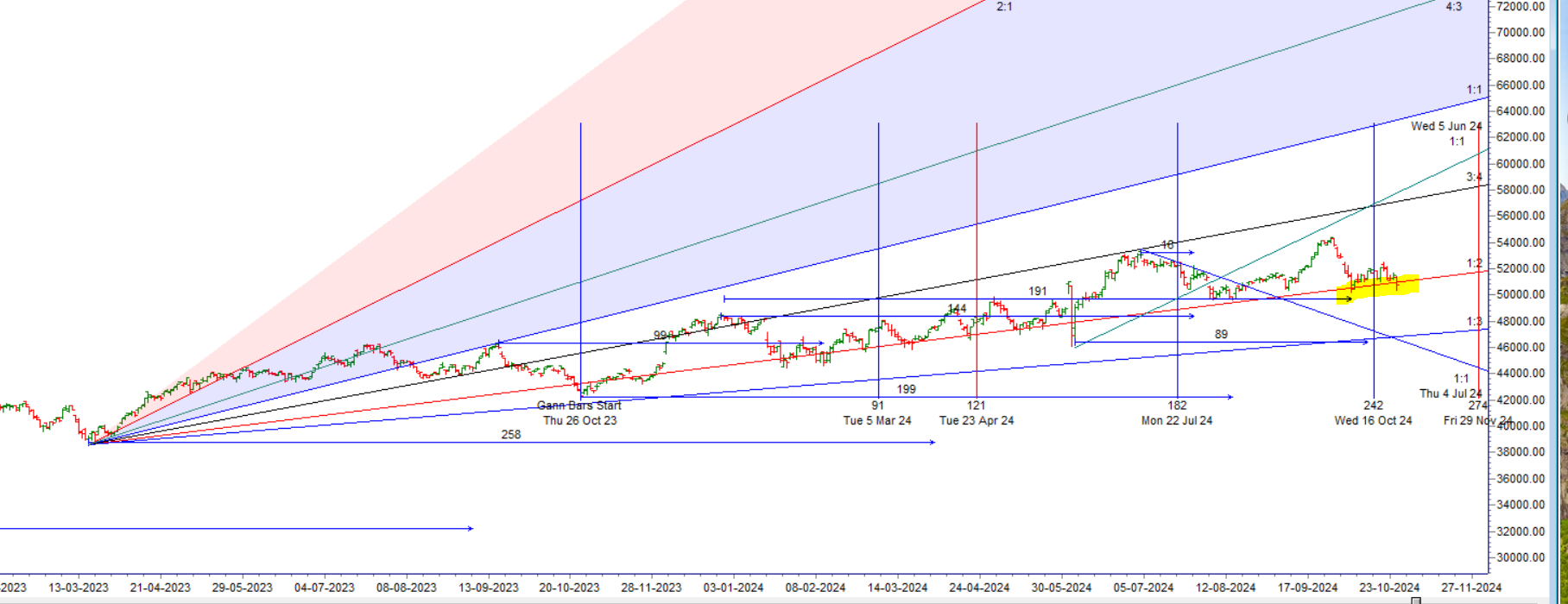

Bank Nifty bounced from its Gann angle support zone, as shown in the chart below. The next two days are crucial based on Bayer’s astro date, as discussed in the video, and we could see a 500–729 point move in Bank Nifty over the next 2–3 trading sessions. With ICICI Bank’s results coming up over the weekend, being an index heavyweight, it adds further importance to the upcoming market movement.

Bayer Rule 31: The trend changes when Venus in declination reaches an extreme beyond 23 degrees, 26 minutes, and 51 seconds.

Bayer Rule 30: The trend changes when Venus in declination passes the extreme declination of the Sun.

Bayer Rule 9: Major market changes occur when Mercury passes over 19 degrees, 36 minutes of Scorpio and Sagittarius, and also over 24 degrees, 14 minutes of Capricorn

Great numbers indeed, especially at a time when most banks are reporting higher provisions on a QoQ basis. ICICI Bank continues to trade at premium valuations compared to Kotak and HDFC Bank, and it’s clear why it commands that premium. For now, ICICI Bank seems to have no major areas of concern.

Bank Nifty saw a decline due to Indusbank results but still failed to hold 07 Oct 2024 Low In the last 30 minutes, we saw notable short covering. Till price is holding 50653 on closing basis buylls can attamept a rally back to 51300.

The recent news regarding Israel could be interpreted positively for global financial markets:

- Israel has refrained from any large-scale attacks on civilians, nuclear sites, or oil fields, and there are no signs of sustained military action.

- This action mirrors past symbolic gestures, similar to Iran’s previous moves towards Israel.

- The probability of an Iranian retaliation appears very low.

- Financial markets are driven by probability assessments, and the likelihood of further escalation seems minimal, which could benefit global markets.

- The U.S. has confirmed that all direct confrontations between Iran and Israel are now resolved.

Today, October 27, marks 16 years since the historic low of October 27, 2008. With ICICI Bank reporting strong numbers, the month nearing its close, and Foreign Institutional Investors (FIIs) actively buying both in index and stock futures, a short-term relief rally could be on the horizon. Equity buying or selling typically follows the FnO cycle. FIIs first take long positions in FnO, then start buying equities to induce a rally, followed by gradually liquidating their FnO longs.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 50871 for a move towards 51098/51325/51554.Bears will get active below 50643 for a move towards 50416/50188/49961.

Traders may watch out for potential intraday reversals at 09:27,11:33,12:20,01:45,02:49 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 20.4 lakh, with liquidation of 1.6 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of SHORT positions today.

Bank Nifty Advance Decline Ratio at 03:09 and Bank Nifty Rollover Cost is @54325 closed below it.

Bank Nifty Gann Monthly Trade level :51820 closed above it.

Bank Nifty closed above its 100 SMA @51511 Trend is Sell on Rise till below 51511

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51000 strike, followed by the 51500 strike. On the put side, the 50500 strike has the highest OI, followed by the 50000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 50500 -51500 range.

The Bank Nifty options chain shows that the maximum pain point is at 50800 and the put-call ratio (PCR) is at 0.76. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The first losses leave the deepest traces. Over time, however, you get used to it and the subsequent losses are no longer perceived with the same intensity, no matter how great they may be. The trader feels indifferent: “Oh, it doesn’t matter whether I lose the money or not!”

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51568. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 50814, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 50838 Tgt 50950, 51200 and 51398 ( BANK Nifty Spot Levels)

Sell Below 50729 Tgt 50610, 50444 and 50225 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.