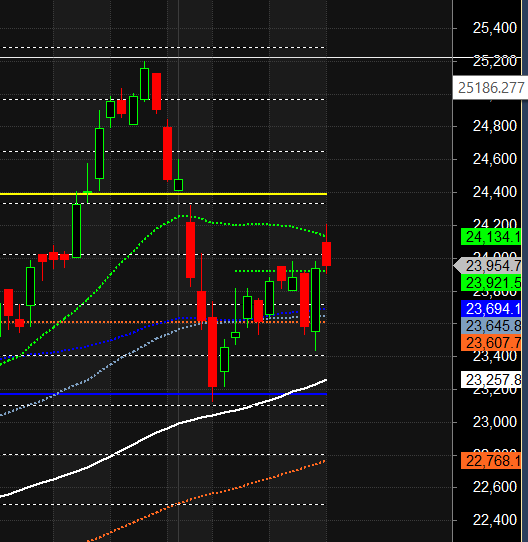

Finance Nifty has closed above 23,824 (Jupiter Declination High) and 23,921 (Gann Annual TC level). Today, HDFC Bank saved Finance Nifty from a deeper cut, despite Kotak and other banks declining. Tomorrow, we have the Sun’s ingress into Scorpio, which falls under a water sign and typically signals bearishness.

PSU Banks should be kept on the radar. Below 23,899, bears will gain the upper hand, while bulls will take control above 24,108.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 23976 for a move towards 24053/24131/24208 . Bears will get active below 23899 for a move towards 23816/23707/23630/23555.

Traders may watch out for potential intraday reversals at 09:37,10:30,11:29,12:57,02:42 How to Find and Trade Intraday Reversal Times

Finance Nifty September Futures Open Interest Volume stood at 85200 with liquidation of 1350 contracts. Additionally, the increase in Cost of Carry implies that there was a liquidation of LONG positions today.

Finance Nifty Advance Decline Ratio at 05:14, Finance Nifty Rollover Cost is @23628 closed above it

Finance Nifty Gann Monthly Trade level :23921 close above it.

Finance Nifty closed ABOVE 50 SMA, Trend is Buy on Dips till above 23777.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 22964-23648-24331. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 24000 strike, followed by the 24100 strike. On the put side, the 23900 strike has the highest OI, followed by the 23800 strike. This indicates that market participants anticipate Finance Nifty to stay within the 23800-24100 range.

The Finance Nifty options chain shows that the maximum pain point is at 24000 and the put-call ratio (PCR) is at 0.81. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

The first losses leave the deepest traces. Over time, however, you get used to it and the subsequent losses are no longer perceived with the same intensity, no matter how great they may be. The trader feels indifferent: “Oh, it doesn’t matter whether I lose the money or not!”

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 24169. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24040, Which Acts As An Intraday Trend Change Level.

FIN Nifty Expiry Range

Upper End of Expiry : 24127

Lower End of Expiry : 23782

FIN Nifty Intraday Trading Levels

Buy Above 23970 Tgt 24000, 24024 and 24050 ( FIN Nifty Spot Levels)

Sell Below 23920 Tgt 23866, 23830 and 23800 (FIN Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.