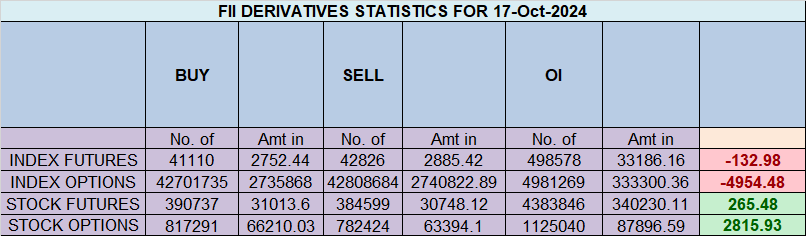

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 252 contracts worth ₹16 crores, resulting in a decrease of 10540 contracts in the net open interest. FIIs covered 5897 long contracts and covered 4181 short contracts, indicating a preference for covering long positions and covering short positions. With a net FII long-short ratio of 0.55, FIIs utilized the market fall to exit long positions and exit short positions in Nifty futures. Clients added 17466 long contracts and added 4253 short contracts. FII are holding 33 % Long and 67 % Shorts in Index Futures and Clients are holding 63 % Long and 37% Shorts in Index Futures.

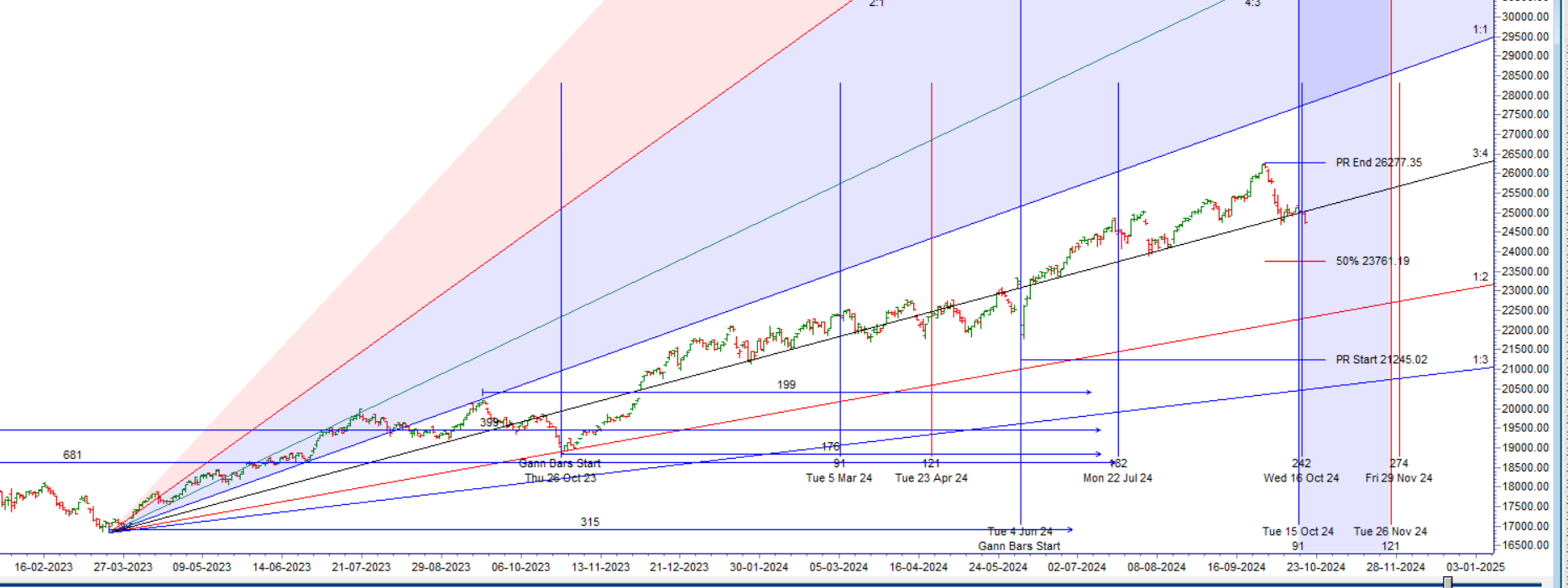

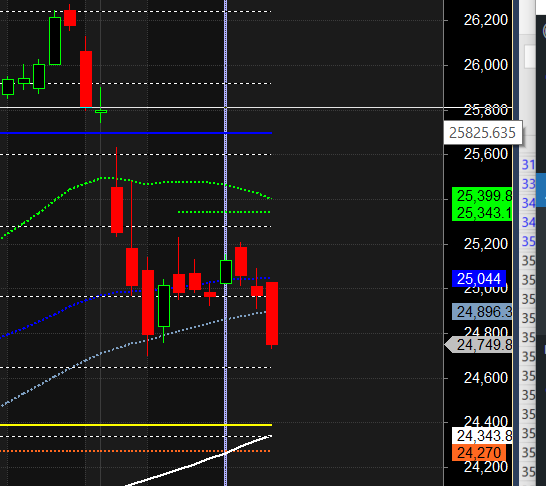

Nifty formed a DOJI, and we have a confluence of time cycles—both Gann and astro— as discussed in the video below. The price has been stuck in the 25,235–24,900 range for the last seven trading sessions. With the convergence of price and time, this range is likely to break within the next two days. A break below 24,900 could lead to a fall towards the recent swing low of 24,700, while holding above this level could trigger a rally towards 25,343/25,400 once the price clears 25,050.

Intraday traders should focus on the first 15 minutes’ high and low to capture the trend for the day.

FIIs have been continuously selling net equities in India. So far in October, FIIs have sold a massive ₹74,730 crore worth of shares in the market. This marks the highest-ever monthly net selling by FIIs, surpassing the previous record of ₹68,308 crore in March 2020, when COVID-19 began spreading globally.

Meanwhile, DIIs have been buying equities during the week. The heavy equity selling by FIIs yesterday could indicate that we are nearing the bottom. (I follow the premise that the equity cycle lags behind the F&O cycle, and high activity in equities generally signals the culmination of that particular cycle.)

We saw the impact of the Gann and astro cycles, leading to a significant drop in Nifty as it broke the Gann angle. Tomorrow, we are likely to open with a gap down and break the last swing low of 24,694 from October 7. With Venus Ingress tomorrow, the first 15 minutes’ high and low will again be crucial in determining the day’s trend. This marks the third week of correction, with the price having already broken last month’s low of 24,754. Bulls need a move above 24,920 for a short-term bottom to form.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24792 for a move towards 24871/24950/25029. Bears will get active below 24634 for a move towards 24554/24475/24396

Traders may watch out for potential intraday reversals at 09:15,10:46,11:53,12:36,02:37 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.35 lakh cr , witnessing a liquidation of 1.89 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 10:40 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25343 close below it.

Nifty closed Below its 50SMA @25093 Trend is Sell on Rise till above 24900

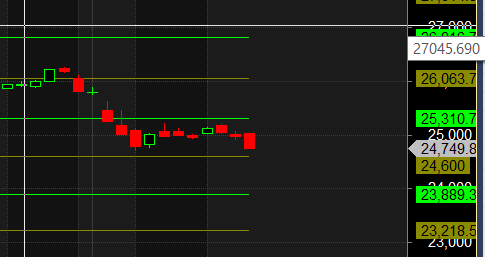

Nifty options chain shows that the maximum pain point is at 24700 and the put-call ratio (PCR) is at 0.95 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24800 strike, followed by 24900 strikes. On the put side, the highest OI is at the 24600 strike, followed by 24500 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24500-24800 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 7421 crores, while Domestic Institutional Investors (DII) bought 4973 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

The first losses leave the deepest traces. Over time, however, you get used to it and the subsequent losses are no longer perceived with the same intensity, no matter how great they may be. The trader feels indifferent: “Oh, it doesn’t matter whether I lose the money or not!”

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25433 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24884, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24729 Tgt 24777, 24816 and 24864 ( Nifty Spot Levels)

Sell Below 24640 Tgt 24610, 24575 and 24525 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.