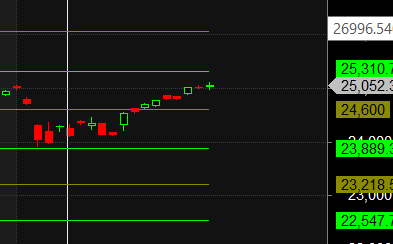

Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 2169 contracts with a total value of 177 crores. This activity led to a decrease of 36938 contracts in the Net Open Interest.

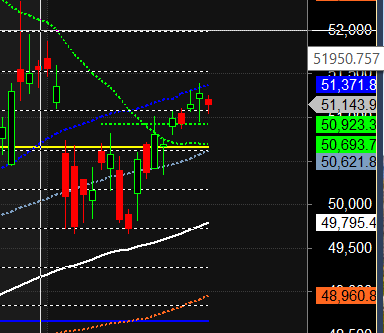

Bank Nifty broke out of the NR21 pattern, and the price continued to move higher forming outside bar pattern. The last monthly expiry was at 50888 , and we are now trading almost 400 points above that level, even after the decline observed on August 5th. Bulls have the upper hand as long as 50923 is held, with potential targets at 51500-51668. With the Gann Date today as discussued in below video , the first 15 minutes’ high and low will be crucial for guiding traders throughout the day.

Bank Nifty had an silent monthly expiry again forming Inside Bar with NR21 pattern, indicating that we may experience a volatile ride in the next two trading sessions. Tomorrow marks the end of Mercury Retrograde and Venus is also changing houses, suggesting a highly significant astrological date and today was the important gann date. . The market has been rising on Weak Breadth in the last two sessions. As long as Bulls are holding above 51000, they will have the upper hand towards 51500-51668.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 51230 for a move towards 51445/51679 Bears will get active below 51006 for a move towards 50782/50557

Traders may watch out for potential intraday reversals at 09:50,11:16,12:41,01:10,02:03 How to Find and Trade Intraday Reversal Times

Bank Nifty Aug Futures Open Interest Volume stood at 22.3 lakh, with addition of 8.7 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a additon of LONG positions today.

Bank Nifty Advance Decline Ratio at 01:11 and Bank Nifty Rollover Cost is @51740 closed above it.

Bank Nifty Gann Monthly Trade level :50923 closed above it.

Bank Nifty closed below 20 SMA @51371 Trend is Sell on Rise

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51300 strike, followed by the 51500 strike. On the put side, the 51000 strike has the highest OI, followed by the 50800 strike.This indicates that market participants anticipate Bank Nifty to stay within the 50800-51500 range.

The Bank Nifty options chain shows that the maximum pain point is at 51300 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Your Mental Toughness is going to be the key to whether you make it or break it as a trader. I know of two MAJOR things that you can do to develop your Mental Toughness for trading. The first is to keep a journal.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51472. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 51472, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 51200 Tgt 51323, 51485 and 51666 ( BANK Nifty Spot Levels)

Sell Below 51100 Tgt 51000, 50888 and 50729 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.