Foreign Institutional Investors (FIIs) exhibited a Bullish Stance in the Bank Nifty Index Futures market by Buying 10770 contracts with a total value of 824 crores. This activity led to a increase of 3322 contracts in the Net Open Interest.

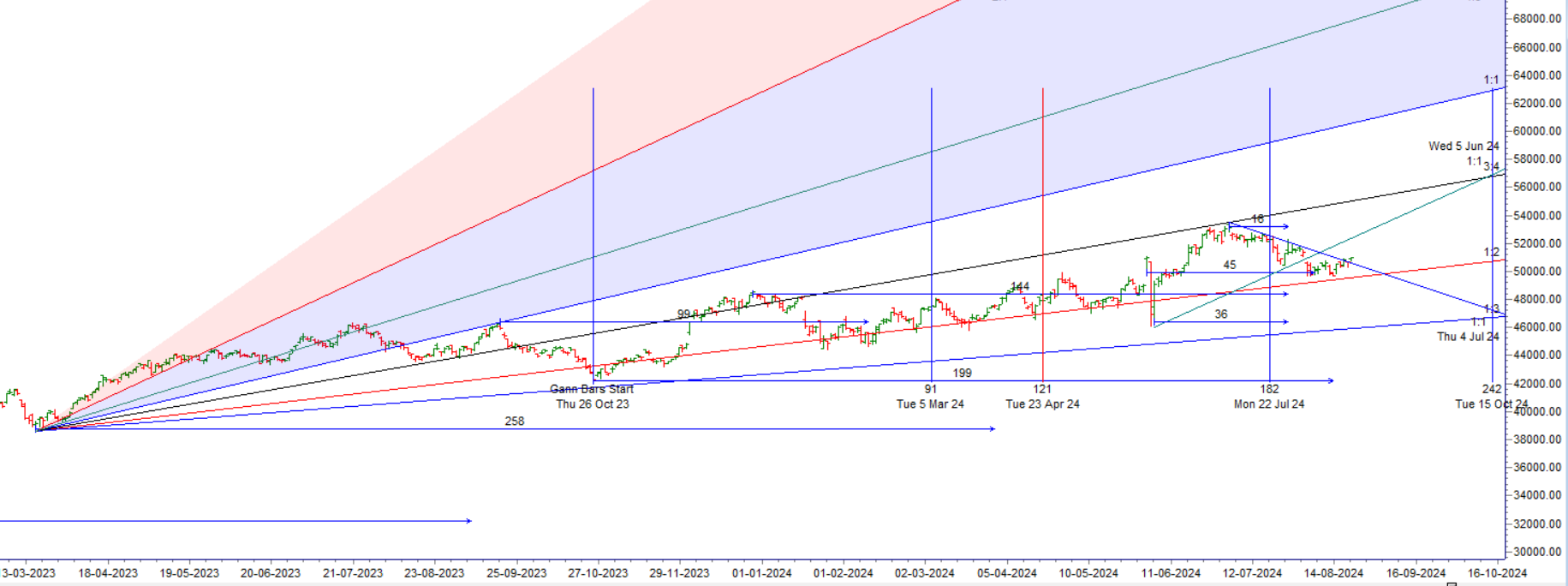

Bank Nifty reacted at the upper end of the Gann angle, as shown in the chart below, with the price closing below 50,728 and forming a DOJI—an indication of potential bearishness. The bearish signal is reinforced by the price closing below the Sun-Mercury conjunction day. Tomorrow, with the Sun moving into Virgo, PSU stocks should be kept on the radar for potential opportunities.

Bank Nifty has broken out above 50,923 and also surpassed the upper end of the Gann angle, indicating an upward price movement. Since today marks the weekly close, the Bulls need to secure a close above the 50,830-50,900 range to confirm a short-term bottom. On the other hand, the Bears will aim to close below the 50,777-50,729 range to set the stage for a trending move next week. This movement could be influenced by ‘Bayer Rule 2: The trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes, leading to a big move.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 50921 for a move towards 51145/51368 Bears will get active below 50698 for a move towards 50475/50252/50029

Traders may watch out for potential intraday reversals at 09:45,11:39,12:39,01:02,02:00 How to Find and Trade Intraday Reversal Times

Bank Nifty Aug Futures Open Interest Volume stood at 26.4 lakh, with liquidation of 0.77 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of SHORT positions today.

Bank Nifty Advance Decline Ratio at 07:05 and Bank Nifty Rollover Cost is @51740 closed above it.

Bank Nifty Gann Monthly Trade level :50923 closed above it.

Bank Nifty closed below 20 SMA @51423 Trend is Sell on Rise

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51000 strike, followed by the 51500 strike. On the put side, the 50500 strike has the highest OI, followed by the 50300 strike.This indicates that market participants anticipate Bank Nifty to stay within the 50500-51200 range.

The Bank Nifty options chain shows that the maximum pain point is at 51000 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

If you have just experienced a significant loss in the market, you are going through emotional pain whether you know it or not. To be clear, a big loss is relative to the trader. For some perfectionist, a big loss could be losing 2% on a trade or for the riverboat gamblers; it could be a larger figure.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 50707 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 51023, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 51000 Tgt 51112, 51238 and 51397 ( BANK Nifty Spot Levels)

Sell Below 50900 Tgt 50800, 50666 and 50555 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.