Bayer Rule 27:** Significant tops and major bottoms occur when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes. This influence will become evident once today’s high of 23,719 or today’s low of 23,450 is broken. A breakout on either side will lead to a move of 250-300 points within two trading sessions in Finance Nifty. Exit all options trades before the FM finishes the speech, as we will see a massive premium erosion if there are no negative or positive surprises in the budget. It has been observed that the interim budgets in 2014 and 2019 led to short-term trend changes, as shown in the video below.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 23684 for a move towards 23761/23838 . Bears will get active below 23529 for a move towards 23452/23375/23298.

Traders may watch out for potential intraday reversals at 09:16,10:01,01:39,02:06,02:59 How to Find and Trade Intraday Reversal Times

Finance Nifty June Futures Open Interest Volume stood at 82800 with liquidation of 1700 contracts. Additionally, the increase in Cost of Carry implies that there was a closure of LONG positions today.

Finance Nifty Advance Decline Ratio at 11:08, Finance Nifty Rollover Cost is @23143 closed above it

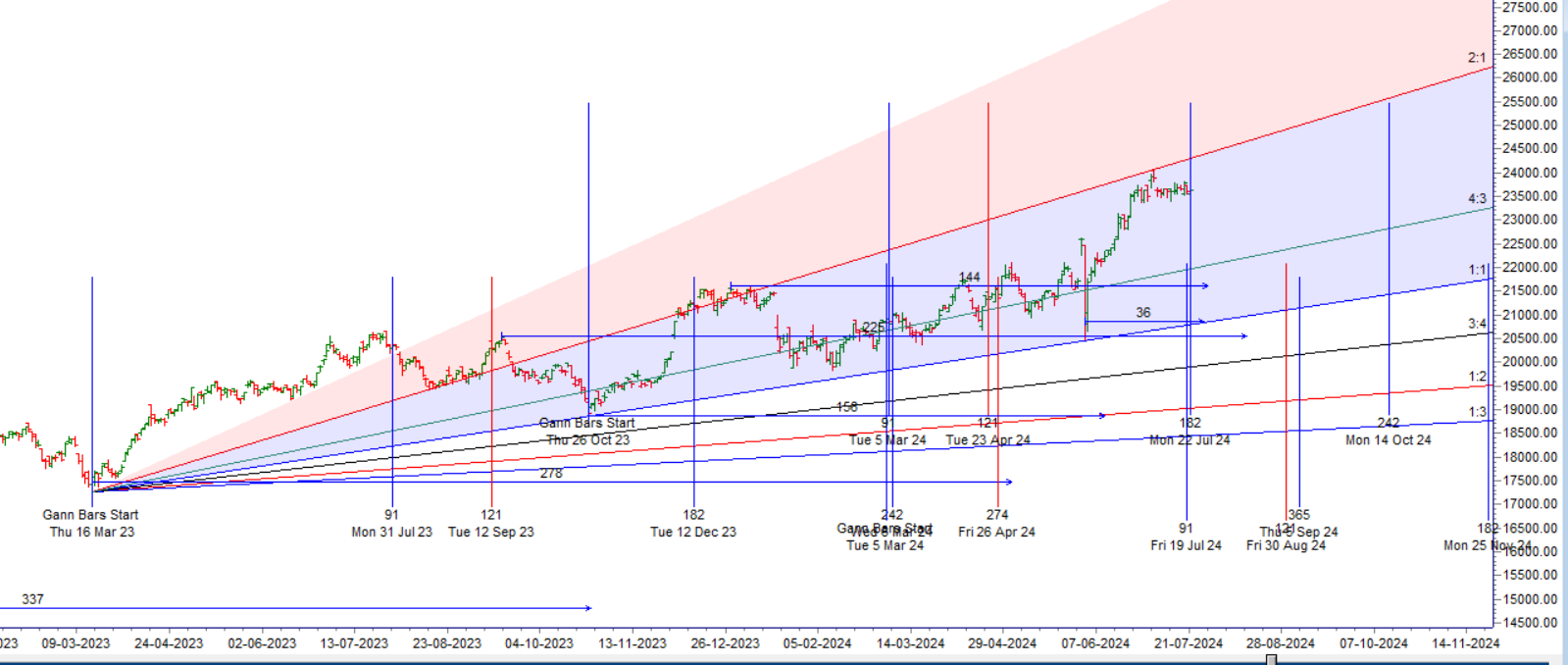

Finance Nifty Gann Monthly Trade level :23418 close above it.

Finance Nifty closed above 20/50/100 SMA, Trend is Buy on Dips till above 23600.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 22964-23648-24331. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 23700 strike, followed by the 23800 strike. On the put side, the 23600 strike has the highest OI, followed by the 23500 strike. This indicates that market participants anticipate Finance Nifty to stay within the 23500-23800 range.

The Finance Nifty options chain shows that the maximum pain point is at 23650 and the put-call ratio (PCR) is at 0.95. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Trader make Error because of expectation, Our Mind think because pattern has emerged its giving us an EDGE on that particular trade and we have no way of knowing it but over a series of trade it will show the effect.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 23650. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 23639, Which Acts As An Intraday Trend Change Level.

FIN Nifty Expiry Range

Upper End of Expiry : 23816

Lower End of Expiry : 23435

FIN Nifty Intraday Trading Levels

Buy Above 23666 Tgt 23699, 23729 and 23777 ( FIN Nifty Spot Levels)

Sell Below 23590 Tgt 23555, 23512 and 23459 (FIN Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.