Intreim Union Budget 2024 will be presented on 23 July 2024 by Honorable Finance Minister Shri Nirmala Sitharaman ji.

The mood in the market is quite Euphoric ,Market is going into Budget with High expectation and no News Leak to Media.

Key Patterns and Observations

Positive Budget Impact

- Pro-Growth Policies: Budgets emphasizing economic growth, infrastructure development, and market-friendly reforms usually boost Nifty.

- Tax Benefits and Incentives: Reduction in corporate taxes, incentives for various sectors, and relief measures for investors tend to have a positive effect.

Negative Budget Impact

- Increased Fiscal Deficit: High fiscal deficit projections often lead to market apprehension and negative movements in Nifty.

- Regulatory Hurdles: Introduction of stringent regulations or higher taxation burdens can dampen market sentiments.

Notable Budget Years

1997

- Key Announcements: Major tax reforms and liberalization measures.

- Market Reaction: Positive surge in Nifty due to pro-growth policies.

2000

- Key Announcements: Focus on IT and infrastructure.

- Market Reaction: Positive reaction driven by sectoral support.

2008

- Key Announcements: Measures to mitigate the global financial crisis.

- Market Reaction: Mixed reactions initially, followed by recovery.

2016

- Key Announcements: Focus on rural economy, infrastructure, and fiscal discipline.

- Market Reaction: Positive response reflecting confidence in fiscal management.

2020

- Key Announcements: Response to COVID-19 economic challenges, healthcare focus.

- Market Reaction: Initial negative reaction due to global uncertainties, followed by recovery.

2021

- Key Announcements: Emphasis on healthcare, infrastructure, and digital economy.

- Market Reaction: Significant positive response, Nifty rallied post-budget.

2022

- Key Announcements: Continued focus on growth, infrastructure, and minimal new taxes.

- Market Reaction: Steady growth in Nifty, reflecting long-term positive sentiment.

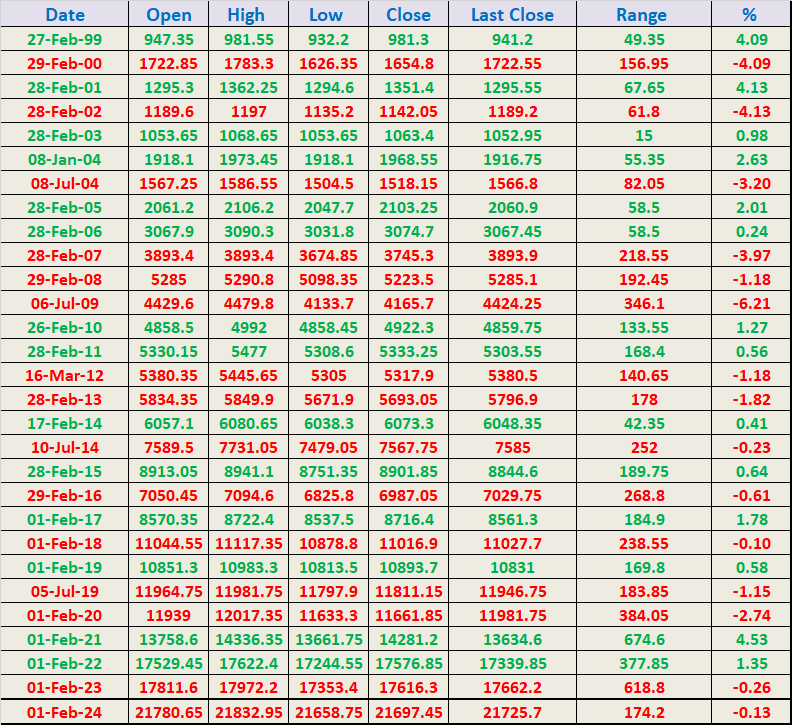

Union Budget is just 2 days away, Below are the Nifty range from 1999-2024. Maximum Range on Budget day is 674 points so big volatile move on cards, so trade cautiously.

Out of 29 Budget Presented When Bank Nifty started Trading we have 14 Budget where we had Positive Close and 15 Budgets we had negative close.

01-Feb-2024 Intraday Chart

01-Feb-2023 Intraday Chart

01-Feb-2022 Intraday Chart

01-Feb-2021 Intraday Chart

Most of the traders end up losing a lot of money when trading on the budget day. As most of them are not prepared both technically and Psychologically to adjust with the wild swings in market. Traders having small capital less than 5 lakhs should just stay away from market and watch the show from sidelines. Protection of Capital is 1 Goal of Trader. We will be sharing levels on Twitter and Facebook to help you navigate on Budget day with Profits.

Analyzing the past 28 Union Budgets reveals that Nifty’s movement is intricately linked to the policies affecting economic growth and market dynamics. Pro-growth and market-friendly budgets generally lead to positive movements in Nifty, while budgets indicating high fiscal deficits or introducing restrictive measures tend to cause declines. Understanding these historical patterns helps investors and traders make more informed decisions during Union Budget announcements.