Comex Gold held steady above $2400/oz as cooler than expected US inflation data bolstered expectations of a rate cut in September US Core CPI rose by 0.1% month-over-month, marking its smallest increase since August 2021, and increased by 3.3% year-over-year, the slowest pace in over three years.

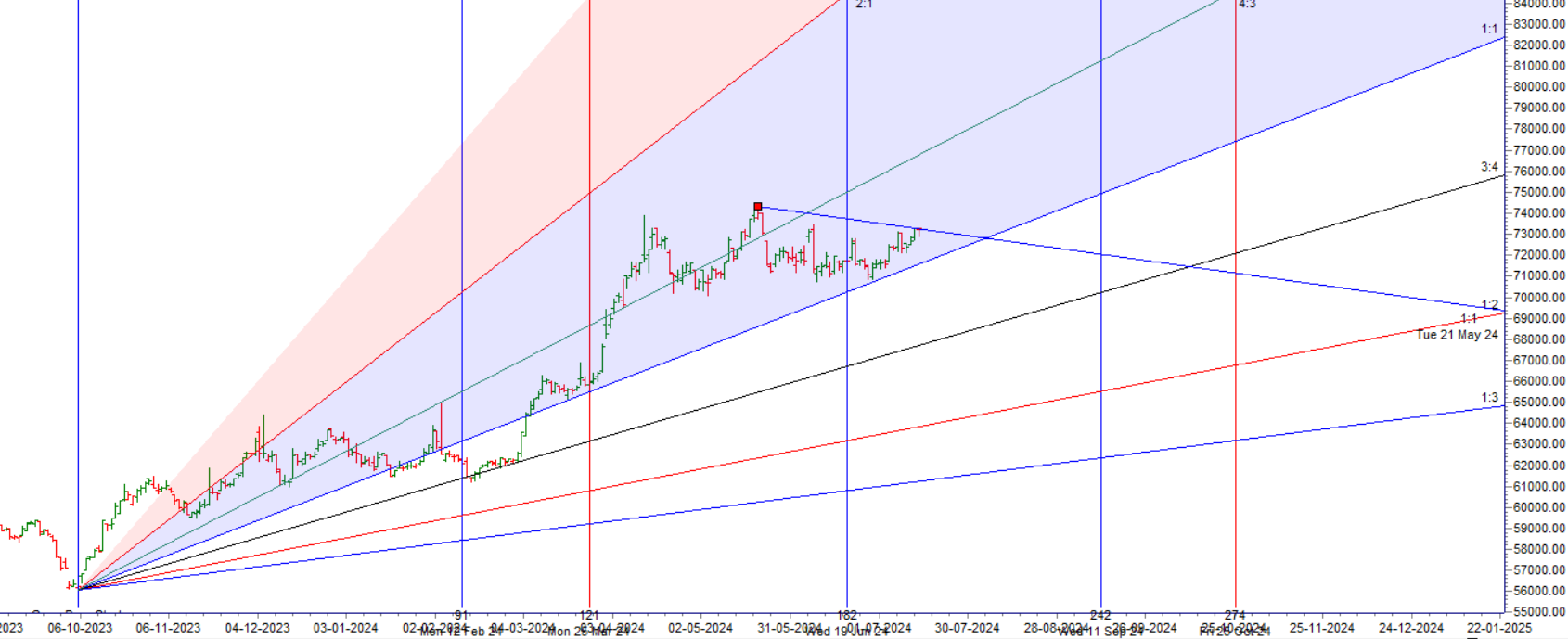

MCX GOLD Gann Angle Chart

Gold is facing resistance at its 1x 1 Gann Angle resistance @73300.

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 71875-72000, Supply in range of 73500-73600

MCX GOLD Harmonic Analysis

ABCD pattern is completed and price can retrace towards 69307.

GOLD Astro/Gann Trend Change Date

15 July Important Gann/Astro Date for Trend Change

Weekly Trend Change Level:73279

Weekly Resistance: 73548,73817,74086,74354

Weekly Support: 73011, 72878,72608,72337,72067,71796

Levels Mentioned are for Current Month Future

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.