Foreign Institutional Investors (FIIs) exhibited a Neutral Stance in the Bank Nifty Index Futures market by Buying 3657 contracts with a total value of 288 crores. This activity led to a increase of 3691 contracts in the Net Open Interest.

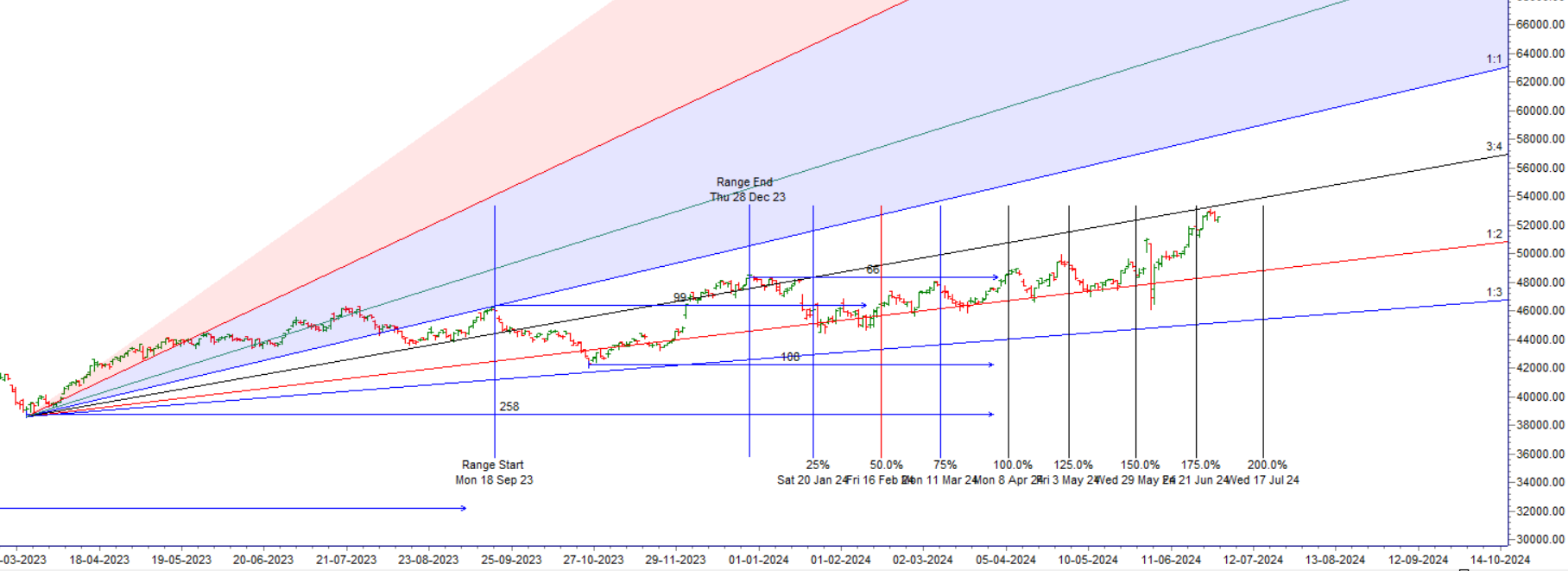

Bank Nifty continue to face resistance at Gann Angle forms a perfect doji with price hitting a fresh all time high. Price mometeum has slowed down but till bulls are holding 52500 Trend is on Upside. Tommrow we will have Weekly/Monthly/Quaterly Closing so last 30 Mins will be crucial. Saturn Retrograde on Weekend and US will get PCE data so MOnday we will see a gap opening so hedge your overnight positions.

Mercury Ingress and Neptune Retrograde (Neptune is considered as the planet of speculation in financial astrology.) today and “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move ” all coming together today suggesting we are in for a volatile ride today.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 52488 for a move towards 52719/52950. Bears will get active below 52027 for a move towards 51797/51566/51335.

Traders may watch out for potential intraday reversals at 09:15,10:21,11:56,01:58,02:28 How to Find and Trade Intraday Reversal Times

Bank Nifty July Futures Open Interest Volume stood at 24.3 lakh, with addition of 1.3 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Bank Nifty Advance Decline Ratio at 06:06 and Bank Nifty Rollover Cost is @52158 closed above it.

Bank Nifty Gann Monthly Trade level :52351 closed above it.

Bank Nifty closed above 20 SMA @50688 Trend is Buy on Dips

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51724-53263-54081. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 53000 strike, followed by the 53500 strike. On the put side, the 52500 strike has the highest OI, followed by the 52000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 52000-53000 range.

The Bank Nifty options chain shows that the maximum pain point is at 52800 and the put-call ratio (PCR) is at 1.05. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

If a trader is confused about what he is doing, the probable win ratio is zero and he might as well give up trading.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 52460 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 52623, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 52411 Tgt 52555, 52729 and 52900( BANK Nifty Spot Levels)

Sell Below 52200 Tgt 52108, 52000 and 51900 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.