In the face of continued robust US global commodity prices despite a thriving economy, controlling inflation is proving increasingly arduous. Traders’ expectations for rate cuts by the Fed have dwindled from six or seven to barely two by the end of 2024. However, the lingering anticipation of Fed generosity, especially during an election year, sustains hopes for further rate reductions. Dollar Index made a fresh High and will hae negative impact on USD INR Pair.

For the first time Iran has possibly directly attacked Israel. State of War. Iran have launched drones and ballistic missiles towards Israel to attack military targets per U.S. and Israeli officials to Axios. When all are short volatlity, a significant volatility shock can be brutal. Gold surged to a fresh record as simmering Middle East tensions intensified buying momentum.

USD INR GANN Chart

USD INR has shown a reversal pattern as per gann heading towards all time of 84.

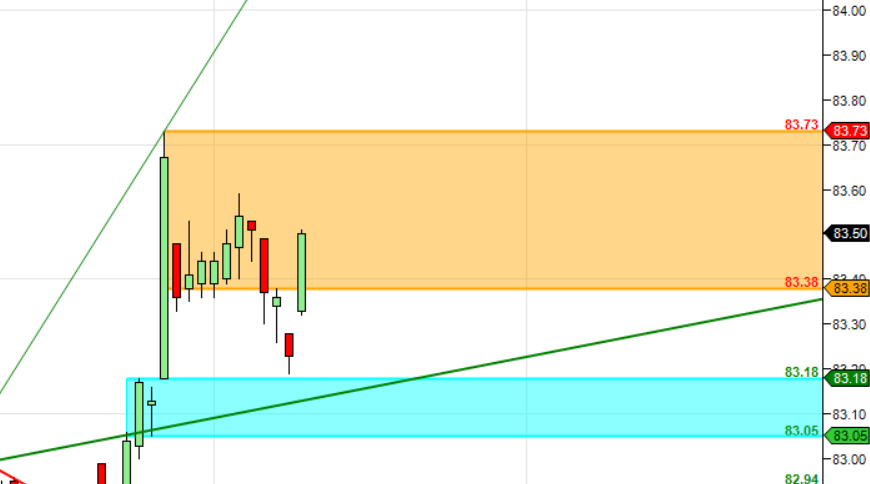

USD INR Supply Demand Zone

India Rupee Supply Demand Chart : Demand in range of 83.30-83.40, Supply in range of 83.53-83.60

USD INR Harmonic

Price is forming the D Leg of Alternate ABCD Pattern heading towards 84/84.55 till above 82.5