For the first time Iran has possibly directly attacked Israel. State of War. Iran have launched drones and ballistic missiles towards Israel to attack military targets per U.S. and Israeli officials to Axios. When all are short volatlity, a significant volatility shock can be brutal. Gold surged to a fresh record as simmering Middle East tensions intensified buying momentum. Silver prices in the domestic market are at lifetime highs amid multiple catalysts like safe-haven demand due to escalating geopolitical tensions, hopes of US interest rate cuts, speculative buying, and a sharp rally in industrial metals.In the key MCX futures platform, prices reached an all-time high of Rs 84,515/kg last week, gaining about 12% in the last two weeks.

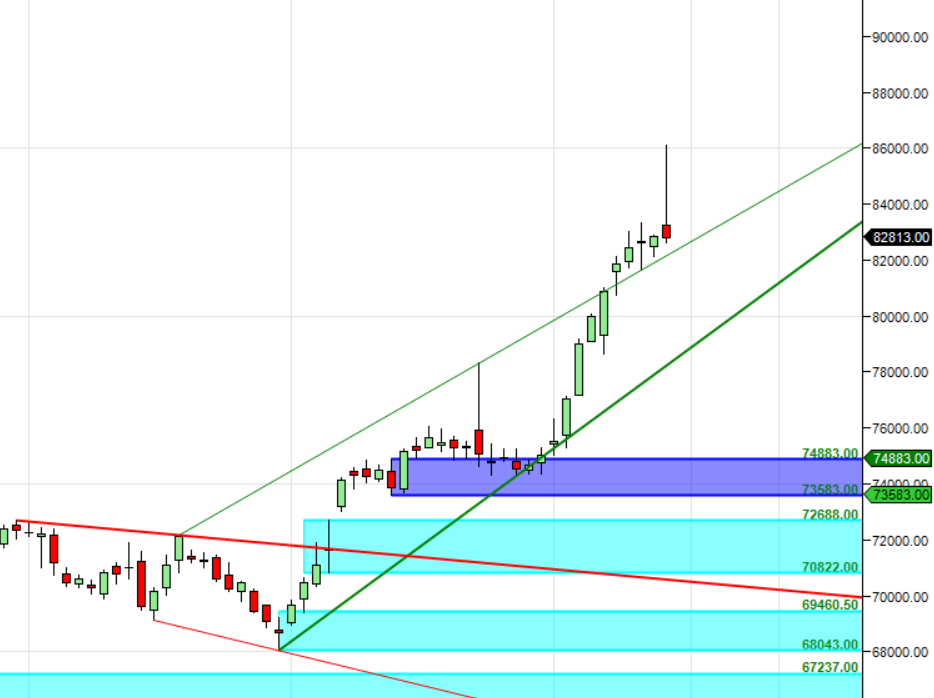

MCX SILVER Gann Angle Chart

SILVER rallied above 4×3 gann angle and Friday made a grav estone doji pattern on Daily chart. Price can target one more upmove towards 2×1 ganna angle at 88000.

MCX SILVER Supply Demand Zone

MCX SILVER Supply Demand Chart : Supply in range of 83400-83500, Demand in range of 82555-82600.

MCX SILVER Harmonic Analysis

ABCD pattern D Leg can extend ride towards 85000/88000

SILVER Astro/Gann Trend Change Date

15 April Important Gann/Astro Date for Trend Change

Weekly Trend Change Level:82944

Weekly Resistance:83521,84100,84681,85265

Weekly Support: 82369,81796,81225,80656

Levels Mentioned are for May Future

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Trade smartly and safely.