Mars Declination showed its impact on finance Nifty as discussed in below video, with price seeing a impulsive correction, Last Week low was 21216 which needs to be watched closely this week as its low of Inside Bar if broken we can see decline of 300-400 points. Today we will open gap up so 21364-21380 range is crucial for bulls to sustain above it, Unable to do so we can see gap filling.

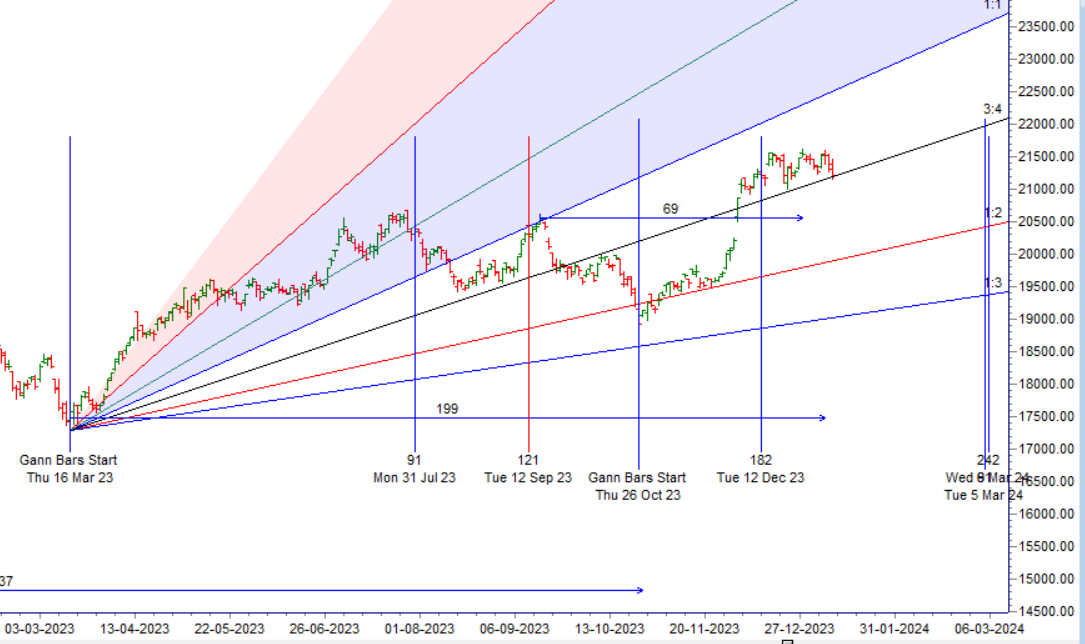

Tomrow we have Moon Declination and SUN Square North Node Aspect, North Node will create voaltlity in the market so be ready for another voaltile move like today. Price has closed below 21216 last week low of inside bar and Doji so bears can be more powerful if tommrow for 1 hour we are trading below 21216. Price is at the crucial gann angle support zone as shown below.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 21406 for a move towards 21480/21553. Bears will get active below 21259 for a move towards 21186/21112/21039 — waiting for 21112/21039

Traders may watch out for potential intraday reversals at 10:08,11:31,1:14,1:53 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 69280 with addition of 13480 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Finance Nifty Decline Ratio at 04:15 and Finance Nifty Rollover Cost is @48411 closed below it.

Finance Nifty Rollover Cost is @21524 closed below it.

Finance Nifty Gann Monthly Trend Change Level : 21363

Finance Nifty has closed below its 20 SMA @21363 for 2 time

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20587-21182-21812 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 21182

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 21300 strike, followed by the 21400 strike. On the put side, the 21200 strike has the highest OI, followed by the 21100 strike. This indicates that market participants anticipate Finance Nifty to stay within the 21200-21400 range.

The Finance Nifty options chain shows that the maximum pain point is at 21300 and the put-call ratio (PCR) is at 0.85. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Learn to function in a tense, unstructured, and unpredictable environment.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 21519 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21197, Which Acts As An Intraday Trend Change Level.

Finance Nifty Intraday Trading Levels

Buy Above 21237 Tgt 21277, 21300 and 21323 ( Finance Nifty Spot Levels)

Sell Below 21150 Tgt 21125, 21100 and 21075 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.