Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bullish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 623 contracts worth 66 crores, resulting in an increase of 6789 contracts in the Net Open Interest.

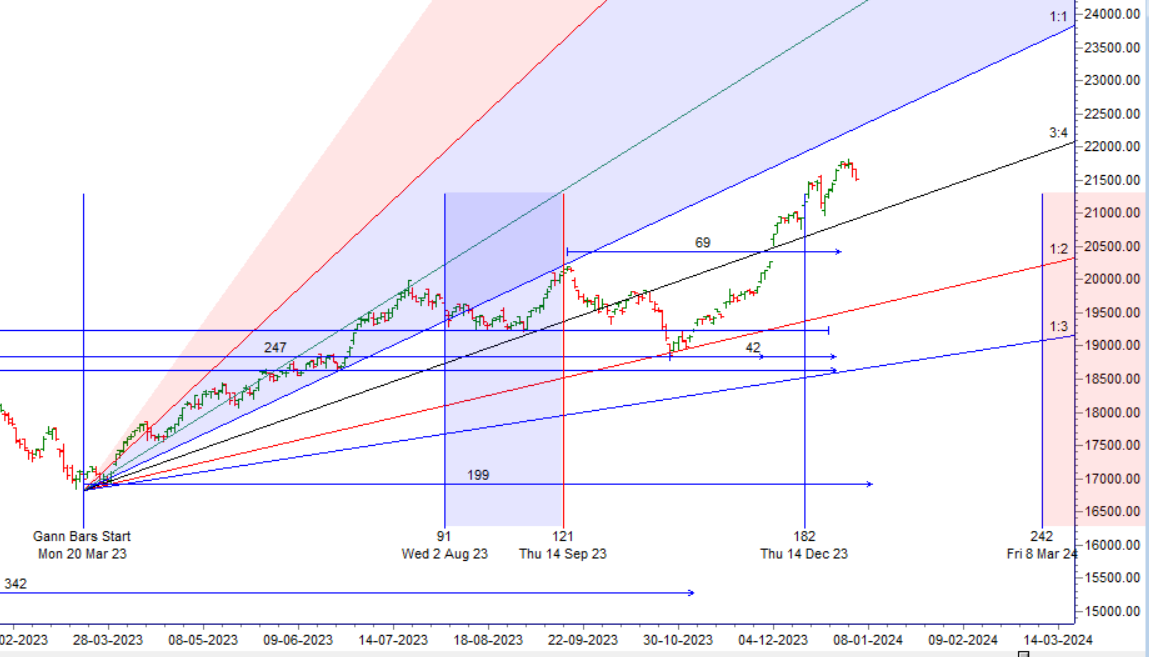

As we approach the last trading day of 2023, it has been a remarkable year for Nifty, posting an impressive 8.4% gain for the month and a substantial 20.3% increase for the entire year, despite numerous geopolitical challenges. For today, keep an eye on the number 21888, Look for a spike down at 3 PM candel also. Wishing you a wonderful New Year celebration, and may you return in 2024 with renewed energy and enthusiasm for the market.

Mercury and Jupiter both have turned direct as discuused in below video.Tommrow Mars is also moving to Capricon, IN last 1 Week Venus/Merucry/Mars has changed sign. As Multiple plannets change sign Market also trend to changes the direction. Mars is an energy plannet so tommrow we can see an explosive move. Till Below 21555 Bears have upperhand.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 21612 for a move towards 21686/21760/21834. Bears will get active below 21464 for a move towards 21391/21317/21243.

Traders may watch out for potential intraday reversals at 10:01,11:40,12:32,1:37,2:16 How to Find and Trade Intraday Reversal Times

Nifty Jan Futures Open Interest Volume stood at 1.18 lakh cr , witnessing a addition of 1500 contracts. Additionally, the increase in Cost of Carry implies that there was a c;osure of LONG positions today.

Nifty Advance Decline Ratio at 19:31 and Nifty Rollover Cost is @21719 closed below it.

Nifty Gann Monthly Trend Change Level : 21727

Nifty is making lower low and heading towards 20 DMA @21321

Nifty options chain shows that the maximum pain point is at 21800 and the put-call ratio (PCR) is at 1.02 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 21800 strike, followed by 21900 strikes. On the put side, the highest OI is at the 21600 strike, followed by 21500 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 21700-21900 levels.

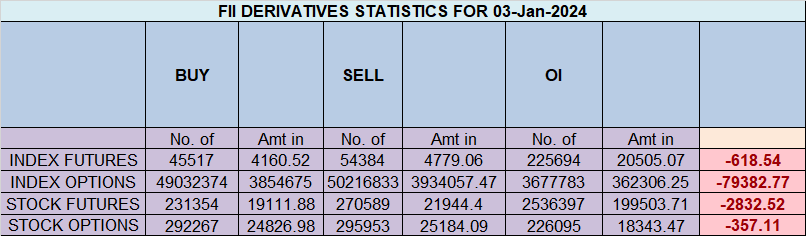

In the cash segment, Foreign Institutional Investors (FII) sold 666 crores, while Domestic Institutional Investors (DII) sold 862 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 20552-21146-21775 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

We as a human programmed not to accept our defeat, that is the core our our evolution we are able to survive because of this mental coding. You might have seen so many people coming back to market after loosing everything in market. So due to this it is very hard for us to accept that we lost in a trade. So we keep on waiting for trade to return in our favour.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 21824 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21653 , Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 21675

Lower End of Expiry : 21358

Nifty Intraday Trading Levels

Buy Above 21529 Tgt 21564, 21599 and 21636 ( Nifty Spot Levels)

Sell Below 21500 Tgt 21460, 21424 and 21388 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.