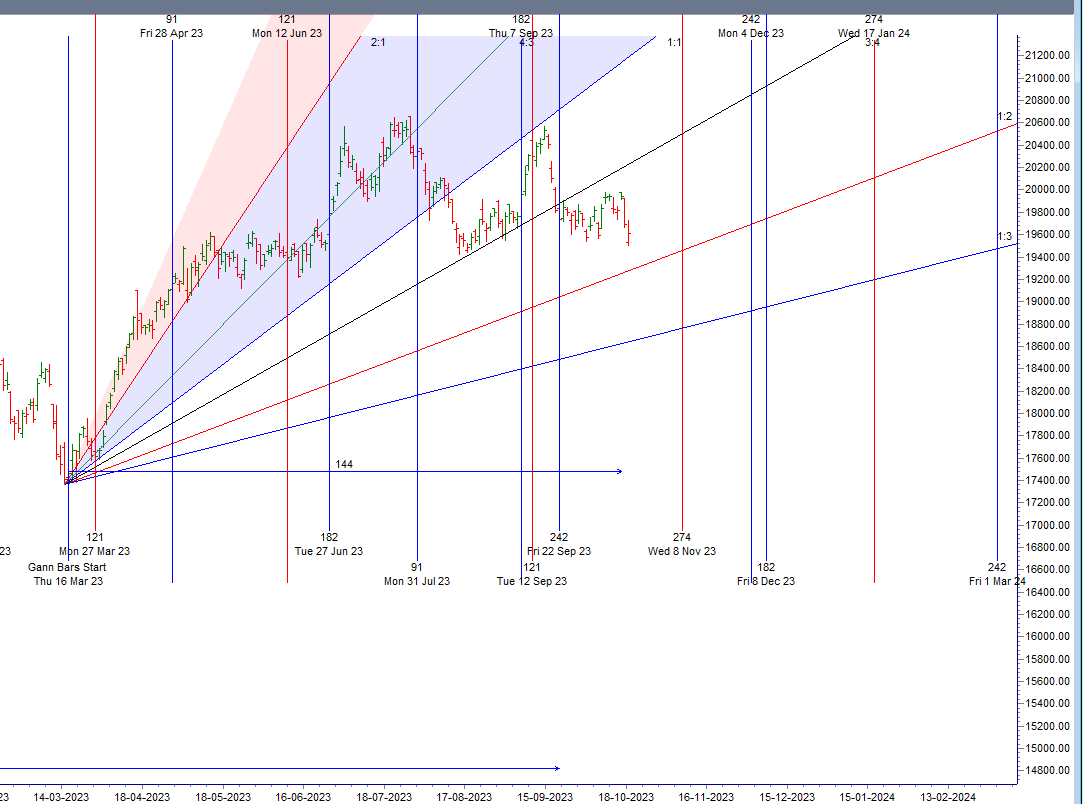

As Discussed in Last Analysis

We have seen Impact of Gann 144 Days and Astro Cycle with Mars/Mercury/Venus/North node. 19666-19683 range is importnat demand zone If 19666 and sustained below it for 15 mins 19500/19412 quiet possible as Mercury Opposition North Node Aspect is forming again voaltile day is coming.

We have multiple Astro Events today which Involves Sun Mercury Moon and North Node

- Moon Extreme Decliantion

- Sun Conjunct Mercury

- “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move “

- Mercury Opposition North Node

- Solar Eclipse Gann Date

Finanec Nifty has broken its last Swing Low of 19534 on intraday basis, Today any move below 19525 can lead to quick fall towards 19444/19323, On Upside Bulls need a close above 19683 for short term bearishness to fade away. Intraday Traders can watch out for first 15 mins High and Low to capture the trend of the day using Ratio Indicator

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 19683 for a move towards 19769/19840. Bears will get active below 19561 for a move towards 19487/19416

Traders may watch out for potential intraday reversals at 9:28,10:37,11:36,1:26,2:03 How to Find and Trade Intraday Reversal Times

Finance Nifty Oct Futures Open Interest Volume stood at 77320 with liquidation of 4040 contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Finance Nifty Advance Decline Ratio at 09:10, Finance Nifty Rollover Cost is @19961 closed below it

Finance Nifty closed above 20/50/100 SMA and heading towads 19200 till we close below 19683.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 21140-20529-19953 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has reacted from 19953

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 19700 strike, followed by the 19800 strike. On the put side, the 19500 strike has the highest OI, followed by the 19400 strike. This indicates that market participants anticipate Finance Nifty to stay within the 19500-19800 range.

The Finance Nifty options chain shows that the maximum pain point is at 19650 and the put-call ratio (PCR) is at 0.93. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

By implementing contingency planning, you can take swift, decisive action the instant one of your positions changes its behavior or is hit with an unexpected event.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 19837. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19695 , Which Acts As An Intraday Trend Change Level.

FIN Nifty Intraday Trading Levels

Buy Above 19630 Tgt 19666, 19699 and 19729 ( Fin Nifty Spot Levels)

Sell Below 19555 Tgt 19512, 19485 and 19444 (FIN Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.