Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Bank Nifty Index Futures market by Shorting 9814 contracts worth 659 crores, resulting in a increase of 6778 contracts in the Net Open Interest.

As Discussed in Last Analysis

Bank Nifty saw a dip today based on our yesterday analysis and fall stopped at 50 SMA, and we saw a decent recovery in 2 half of the session. TOmmrow we have RBI Policy and Bank Nifty will be completing 99 Days from 16 March Low so if Price is unable to close above 45000 we can see a revisit of 44500 Low. Todays rally was more of short covering. Mercury Trine Jupiter aspect formed today so above 45000 Bulls will have upper hand towards 45170/45378.

Bank Nifty saw the effect of 99 Gann Bars and astro time cycle as disccused in below video, Price has closed below 50 SMA which is short term bearish, Markets are slave of liquidity with RBI sucking out liquidity Banking stocks should be under pressure.

Bank Nifty is doing Gann Price time squaring as price is at 1×1 gann angle and 99 bar time cycle and astro cycle also confluncing as discussed in below video. Be ready for big move as per levels

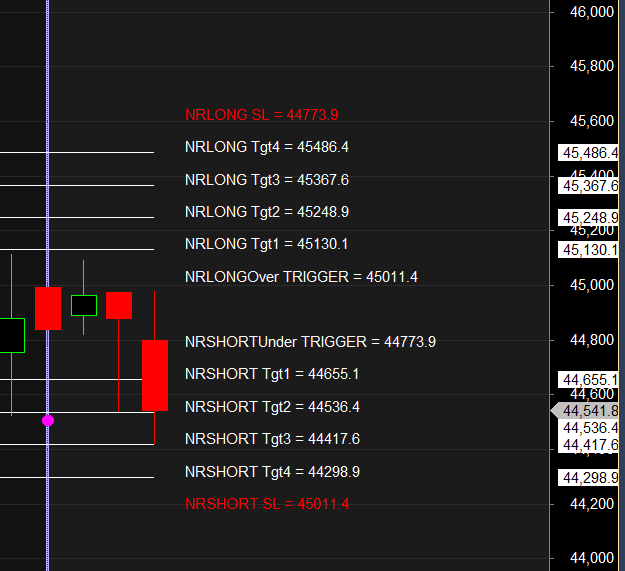

Bank Nifty BUlls need to move above 45011 for a move towards 45130/45248/45367 Below 44773 can see a follow towards 44655/44536/44417– 3 target done

Traders may watch out for potential intraday reversals at 9:15,11:46,12:47,01:39,2:21 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 18.7 lakh, additon of 2 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 5:7 and Bank Nifty Rollover Cost is @46143 and Rollover is at 70.3%

BANk Nifty has broken its 50 SMA support and heading towards 100 SMA @43476

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is closed below 44634

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44500 strike, followed by the 44800 strike. On the put side, the 44300 strike has the highest OI, followed by the 44000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 44000-44500 range.

The Bank Nifty options chain shows that the maximum pain point is at 44300 and the put-call ratio (PCR) is at 0.91. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Years of practice at the game, of constant study, of always remembering, enable the trader to act on the instant when the unexpected happens as well as when the expected comes to pass.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45275. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44826 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 44444 Tgt 44555, 44666 and 44777 (Bank Nifty Spot Levels)

Sell Below 44300 Tgt 44196, 44080 and 43920 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Sir there is a typo in above levels, Please correct

done