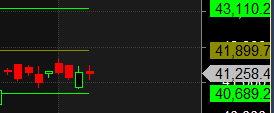

As Discussed in Last Analysis On 05 Nov Venus Opposition Uranus its Key Dates Imp for Global Market and SUN Opposition North Node suggesting volatlity will continue and best to do intraday trade till 08 Nov when SUn goes in Conjuction with Mercury. Today also with gap down we saw a swift recovery. For Swing Trade Bulls need to move above 41425 for a move towards 41627/41829. Bears will get active below 41223/41021/40819.

Last Night all EU and US Market rallies based on Venus Opposition Uranus and we will see Impact on Bank Nifty with gap up open, Last few days Bank NIfty open gap up and close the gap but for Monday we have intraday time cycle at 9:18 Am so we can see big move in first 1 hour only.

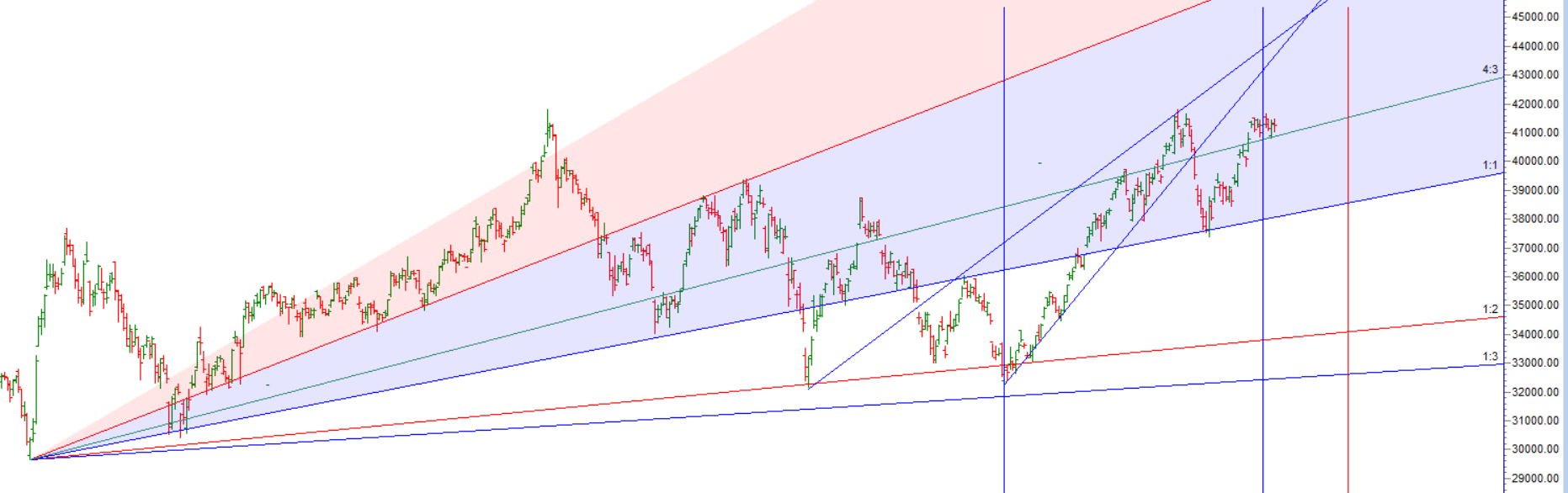

Bank Nifty has been side ways from last 9 trading session, Gann has given lot of importance to No 9 and price is also near gann angle so we can expect an explosive move in Bank Nifty next week. Also we will see impact of Venus Opposition Uranus.

For Swing Trade Bulls need to move above 41425 for a move towards 41627/41829. Bears will get active below 41223/41021/40819.

Intraday time for reversal can be at 9:18/10:02/11:48/12:49/1:23/2:33 How to Find and Trade Intraday Reversal Times

Bank Nifty Nov Future Open Interest Volume is at 20.7 lakh with addition of 0.39 Lakh contract , with increase in Cost of Carry suggesting Long positions were closed today.

Bank Nifty Rollover cost @ 41285 and Rollover is at 76.5 % Closed above it

Bank Nifty as per musical octave trading path can be 40689-41899-43110 take the side and ride the move !!

Maximum Call open interest of 28 lakh contracts was seen at 41500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 32 lakh contracts was seen at 40800 strike, which will act as a crucial Support level.

MAX Pain is at 41500 and PCR @0.85 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Shift from fear of giving back gains and hoping to recover from a losing trade to ‘hoping for more gains on a winning trade and fear of losing more on a losing trade.

For Positional Traders Trend Change Level is 41430 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 41375 will act as a Intraday Trend Change Level.