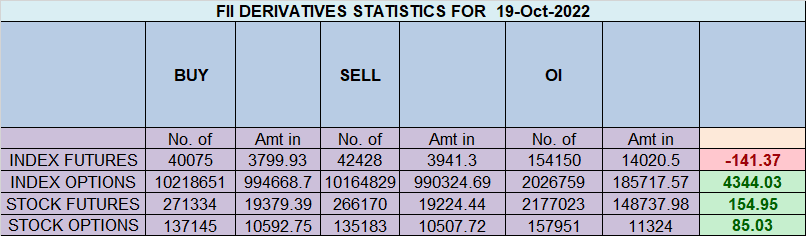

FII sold 2.3 K contract of Index Future worth 141 cores, Net OI has increased by 5.5 K contract 1.5 K Long contract were added by FII and 3.9 K Shorts were added by FII. Net FII Long Short ratio at 0.42 so FII used rise to enter long and enter short in Index Futures.

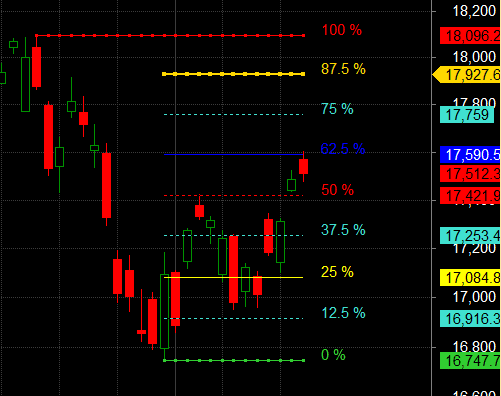

Bulls were able to do 2 target on upside ,Till we are holding 17421 bulls have upper hand. For Swing Traders Bulls will get active above 17490 for a move towards 17556/17621. Bears will get active below 17395 for a move towards 17329/17263/17196

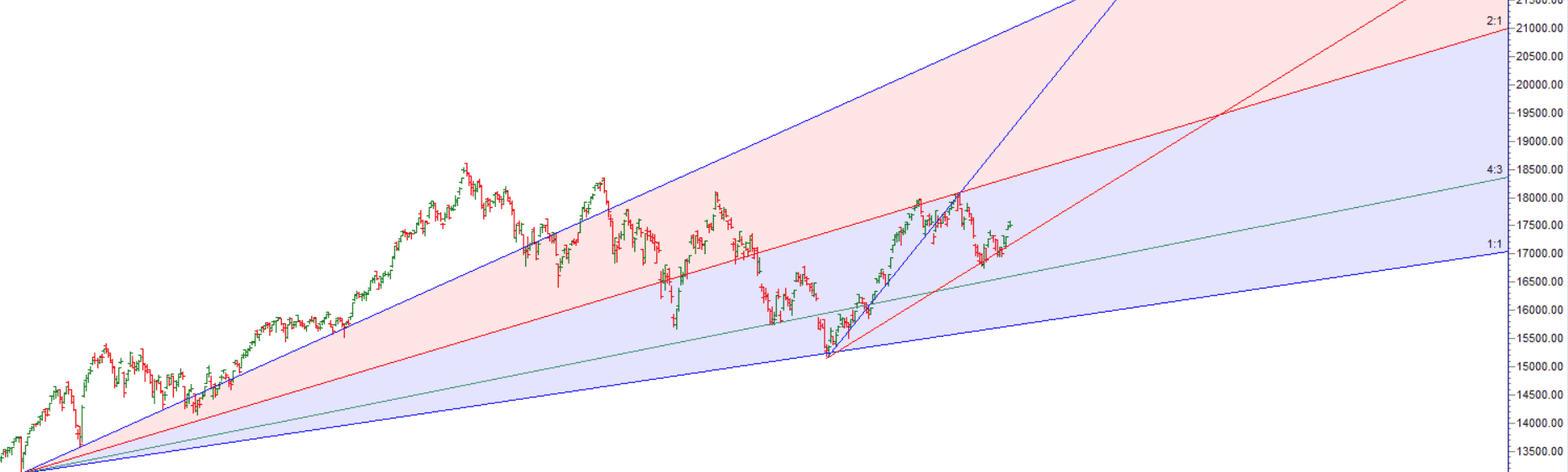

Nifty has touched the musical octave level as show im below chart. 17551-17576 Nifty need to close above this supply range for upmove to continue, TIll 17421 is held Bulls have upper hand Bulls need to close above 17538 for a move towards 17605/17671/17737. Bears will get active below 17408 for a move towards 17342/17275/17209.

17421 is Gann 50% level which gann has give lot of importance. Break of 17421 we will see a fast rise towards 17590. — 17590 done. Now above 17590 can lead to rally towards 17759

Intraday time for reversal can be at 9:43/10:46/11:33/12:18/1:45/2:27 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17600 PCR at 0.98 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 42 lakh contracts was seen at 17600 strike, which will act as a crucial resistance level and Maximum PUT open interest of 45 lakh contracts was seen at 17400 strike, which will act as a crucial Support level

Retailers have bought 435 K CE contracts and 367 K CE contracts were shorted by them on Put Side Retailers bought 147 K PE contracts and 196 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 55.8 K CE contracts and 70.9 K CE were shorted by them, On Put side FII’s sold 99.4 K PE and 30.7 K PE were shorted by them suggesting they have a turned to Neutral Bias.

Nifty Oct Future Open Interest Volume is at 1.09 Cr with liquidation of 4.2 Lakh with increase in cost of carry suggesting Long positions were closed today.

NIfty Rollover cost @ 17028 and Rollover is at 73.4 % closed above it.

FII’s sold 453 cores and DII’s bought 908 cores in cash segment.INR closed at 83.05

#NIFTY50 as per musical octave trading path can be 17044-17551-18058take the side and ride the move !!

Studies show that traders avoid risk when winning and seek risk when losing. This is the exact opposite of what needs to done to sustain in the markets. We must reprogram ourselves and create habits that are unnatural until they become our second nature.

Positional Traders Trend Change Level is 17188 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17531 will act as a Intraday Trend Change Level.

Intraday Trading Levels

Buy Above 17540 Tgt 175789, 17624 and 17666 (Nifty Spot Levels)

Sell Below 17454 Tgt 17421, 17396 and 17343 (Nifty Spot Levels)

Upper End of Expiry : 17608

Lower End of Expiry :17381