FII bought 1.1 K contract of Index Future worth 103 cores, Net OI has increased by 46.7 K contract 23.9 K Long contract were added by FII and 22.8 K Shorts were added by FII. Net FII Long Short ratio at 0.40 so FII used rise to enter long and enter short in Index Futures.

Intraday time for reversal can be at 9:23/10:44/11:42/12:22/1:14/2:30 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17000 PCR at 0.75 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 52 lakh contracts was seen at 17000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 45 lakh contracts was seen at 16800 strike, which will act as a crucial Support level

Nifty Oct Future Open Interest Volume is at 0.83 Cores with addition of 35.1 Lakh with increase in cost of carry suggesting Long positions were added today.

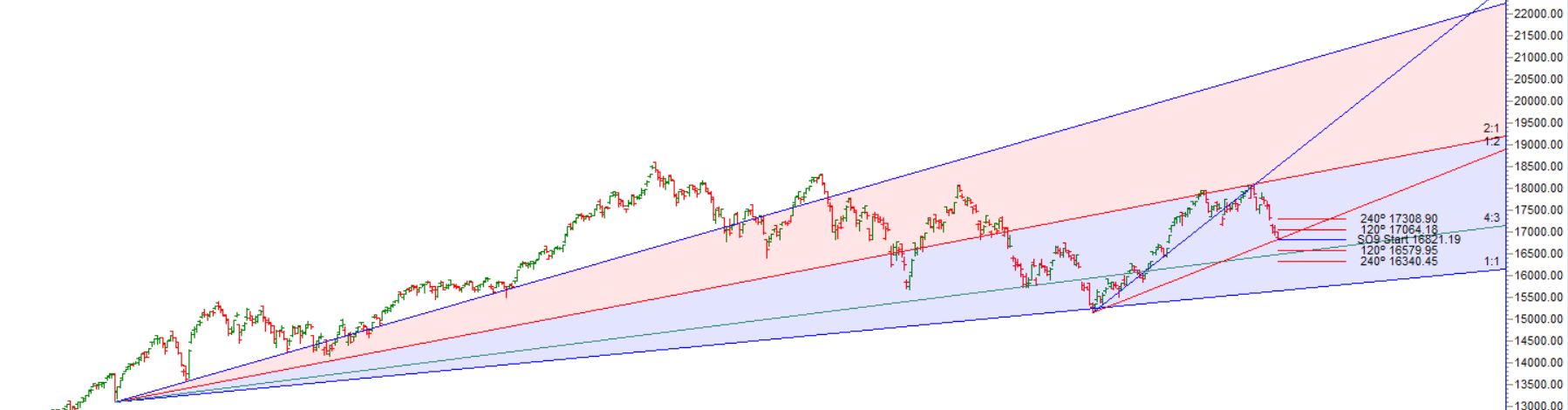

Nifty has seen correction of 1268 points in 9 trading session. 17161 04 Aug low of RBI day suggesting any positive commetary by RBI and we are above 17161 can see move towards 17551

FII’s sold 2772 cores and DII’s bought 2544 cores in cash segment.INR closed at 81.90

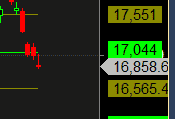

#NIFTY50 READY for another 500 points move as per musical octave 16565- 17044-17551 take the side and ride the move !!

The pain of being wrong seems to increase exponentially in relation to the size of the position. If we normally trade one lots and now we are trading twos, the degree of difficulty in acting quickly when we are wrong is not twice but perhaps five times as great. Herein lies the magic that seems to cast its spell on each traderís psyche. The pain to our ego is in proportion to the size of trades. Avoidance of pain is what keeps us from acting fast. Losing that fear is the key to success. We must trust the process.