FII sold 6.6 K contract of Index Future worth 524 cores, Net OI has increased by 7.4 K contract 413 Long contract were added by FII and 7 K Shorts were covered by FII. Net FII Long Short ratio at 0.35 so FII used rise to enter long and enter short in Index Futures.

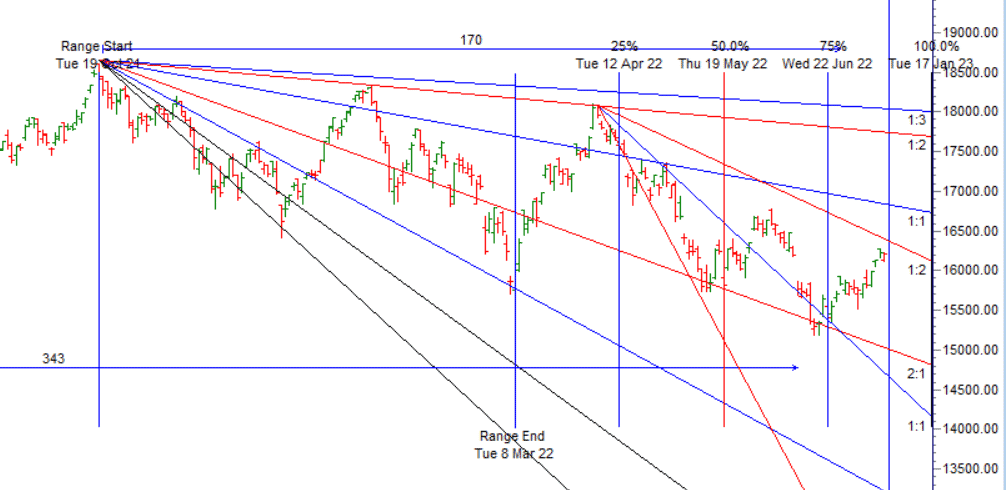

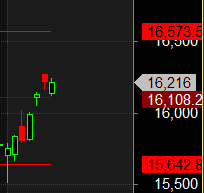

As Discussed in Last Analysis 2 target done and we have seen side ways move as next important astro date is on 12-13 July so monday can be also sideways day. Bulls were able to close above 16236 now waiting for target of 16299/16362/16426. Bears will get active below 16172 for a move towards 16108/16046. Bulls were unable to close above 16236, Tommrow we have Moon Declination so watch out first 15 mins High and Low to take trade. Moon/Mercury/Jupiter has big impact on Nifty also tommrow we have Mercury Square Jupiter HELIO aspect. Bulls need to close above 16236 now waiting for target of 16299/16362/16426. Bears will get active below 16172 for a move towards 16108/16046.

Intraday time for reversal can be at 9:24/10:43/11:40/12:15/1:53/2:46 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16200 PCR at 0.85 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty July Future Open Interest Volume is at 1.18 Cores with addition of 9.9 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Nifty rollover cost @ 15801 and Rollover @66.1 % Closed above the rollover level suggesting bias is Bullish

Maximum Call open interest of 39 lakh contracts was seen at 16300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 50 lakh contracts was seen at 16000 strike, which will act as a crucial Support level. There is total OI of 6.2 Cr on the Call side and 7.2 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having BULLISH Bias.

FII’s sold 170 cores and DII’s bought 296 cores in cash segment.INR closed at 79.59

As per Musical Octave Above 15642 Rally towards 16108. 16108 done now till we are holding 16108 rally towards 16573

Another trigger for over trading is the assumption that if you work a lot,you will gets a lot of money. This principle works in our Life in many areas. When it comes to trading, the opposite is usually true -less is more!