FII bought 8.1 K contract of Index Future worth 667 cores, Net OI has decreased by 3.9 K contract 2 K Long contract were added by FII and 6 K Shorts were covered by FII. Net FII Long Short ratio at 0.33 so FII used rise to enter long and exit short in Index Futures.

As Discussed in Last Analysis We got the perfect turning point and a high voaltile session Bulls were able to do 2 target on upside and bears were unable to sustain below 15378 low made was 15367, Today we should see another volatile move so trade in less quatity. For Swing traders Bulls need to move above 15634 for a move towards 15696/15758/15820. Bears will get active below 15510 for a move towards 15448/15386. Bulls were able to do 1 target on upside and now waiting for 15758/15820 which should be done on gap up on Monday. Astro again helped us in capturing the big move on upside. Next important date is on 28 June/30 June which we wil discuss in coming article. For Swing traders Bulls need to move above 15869 for a move towards 15931/15994/16056. Bears will get active below 15744 for a move towards 15681/15619.

Intraday time for reversal can be at 9:17/11:09/12:49/1:35/2:01/2:50 How to Find and Trade Intraday Reversal Times

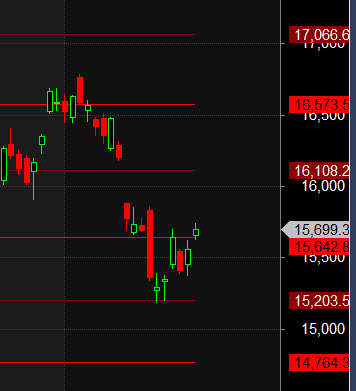

MAX Pain is at 15700 PCR at 0.9 PCR below 0.89 and above 1.3 lead to trending moves, and in between leads to range bound markets.Nifty rollover cost @ 16139and Rollover @69.6 %.

Nifty May Future Open Interest Volume is at 10.98 Cores with liquidation of 1.9 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Maximum Call open interest of 59 lakh contracts was seen at 15700 strike, which will act as a crucial resistance level and Maximum PUT open interest of 72 lakh contracts was seen at 15400 strike, which will act as a crucial Support level. There is total OI of 5.88 Cr on the Call side and 7.77 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having Bullish Bias.

FII’s sold 2353 cores and DII’s bought 2213 cores in cash segment.INR closed at 78.34

Retailers have bought 537 K CE contracts and 520 K CE contracts were shorted by them on Put Side Retailers bought 636 K PE contracts and 613 K PE shorted contracts were added by them suggesting having BEARISH outlook,On Flip Side FII bought 6.2 K CE contracts and 4 K CE were shorted by them, On Put side FII’s bought 19.6 K PE and 21.3 K PE were shorted by them suggesting they have a turned to Bullish Bias.

As per Musical Octave Above 15642 Rally towards 16108

For Positional Traders Stay long till we are holding Trend Change Level 15510 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 115679 will act as a Intraday Trend Change Level.