FII bought 10.5 K contract of Index Future worth 853 cores, Net OI has increased by 10 K contract 7.2 K Long contract were added by FII and 3.3 K Shorts were covered by FII. Net FII Long Short ratio at 0.30 so FII used fall to enter long and enter short in Index Futures.

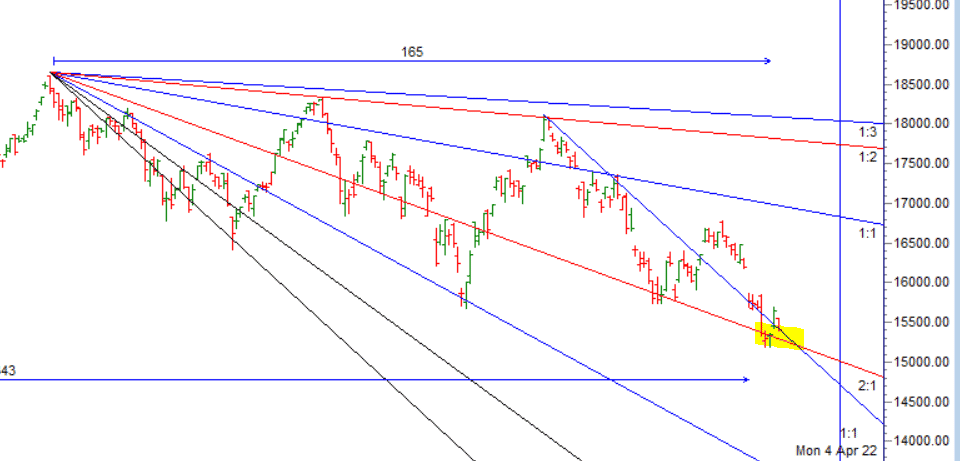

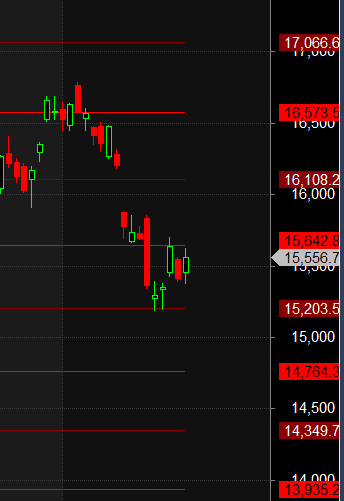

As Discussed in Last Analysis We opened gap down no levels got triggred We have Venus Ingress today which leads to turning point in the market as discussed in below video. For Swing traders Bulls need to move above 15510 for a move towards 15572/15634/15696. Bears will get active below 15378 for a move towards 15315/15253. We got the perfect turning point and a high voaltile session Bulls were able to do 2 target on upside and bears were unable to sustain below 15378 low made was 15367, Today we should see another volatile move so trade in less quatity. For Swing traders Bulls need to move above 15634 for a move towards 15696/15758/15820. Bears will get active below 15510 for a move towards 15448/15386.

Intraday time for reversal can be at 9:45/11:04/12:35/1:30/2:32 How to Find and Trade Intraday Reversal Times

MAX Pain is at 15600 PCR at 0.9 PCR below 0.89 and above 1.3 lead to trending moves, and in between leads to range bound markets.Nifty rollover cost @ 16139and Rollover @69.6 %.

Nifty May Future Open Interest Volume is at 1 Cores with liquidation of 9 Lakh with increase in cost of carry suggesting Long positions were closed today.

Maximum Call open interest of 18 lakh contracts was seen at 15700 strike, which will act as a crucial resistance level and Maximum PUT open interest of 17 lakh contracts was seen at 15400 strike, which will act as a crucial Support level

FII’s sold 2319 cores and DII’s bought 2438 cores in cash segment.INR closed at 78.35

FII have bought 15621 Cr worth of OPtions Today Highest in recent time suggesting we should see trending move as they have adjusted there OPtions Positions for the month.

As per Musical Octave Above 15642 Rally towards 16108

For Positional Traders Stay long till we are holding Trend Change Level 15437 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 15518 will act as a Intraday Trend Change Level.