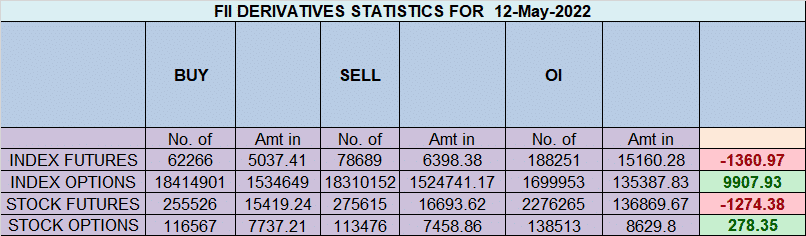

FII sold 16.4 K contract of Index Future worth 1360 cores, Net OI has increased by 2.8 K contract 6.7 K Long contract were covered by FII and 9.6 K Shorts were added by FII. Net FII Long Short ratio at 0.20 so FII used fall to exit long and enter short in Index Futures.

As Discussed in Last Analysis It was highly voaltile day with big range bank nifty is still not able to close above the Mercury Retrograde date High suggesting Bears have upper hand. For Swing trades Bulls need to move above 16191 for a move towards 16254/16318. Bears will get active below 16063 for a move towards 15999/15935/15871.Nifty Weekly Expiry Analysis for 12 May. Bears were able to do all target on downside and we will see gap up open today Bulls need to sustain above 16035 for 16100/16156/16225. Bears will get acctive below 15898 for a move towards 15824/15726/15632

Intraday time for reversal can be at 9:15/10:28/12:04/1:21/2:54 How to Find and Trade Intraday Reversal Times

MAX Pain is at 15900 PCR at 0.79 , Rollover cost @17121 closed below it and rollover @65.6 lowest in 3 months. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty May Future Open Interest Volume is at 1.02 Cores with addition of 0.21 Lakh with increase in cost of carry suggesting SHORT positions were closed today.

Maximum Call open interest of 60 lakh contracts was seen at 16100 strike, which will act as a crucial resistance level and Maximum PUT open interest of 53 lakh contracts was seen at 15800 strike, which will act as a crucial Support level

FII’s sold 5255 cores and DII’s bought 4815 cores in cash segment.INR closed at 77.55

Sell in May and go away look at 2006 charts we might be not out of woods and heading much lower if unable to close above 16000 on weekly close basis

We are into relent less selling and 800 points down on NF in the week. In the last 5 trading days, FII have net sold 32.4 K contracts of NF worth 3K crore approximately. We have to add 21000 crore worth of equity selling to that – it shows that FII are withdrawing money big time from the Indian Markets.

Cut your losses – It’s pretty simple. You will not make it in the markets if you can’t cut your losses. You have to be confident in yourself as a trader to know there are an infinite amount of opportunities in the markets and that you can capitalize on them. That gives you the ability to let the losers go.

For Positional Traders Stay long till we are holding Trend Change Level 16623 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 15854 will act as a Intraday Trend Change Level.

Great