Gann Techniques are technical analysis tools that were developed by the renowned financial trader William Delbert Gann (WD Gann), during his career on Wall Street which spanned the first half of the twentieth century.

As per the Gann technique goes, we have been given certain rules which are known as Gann techniques. The most interesting aspect of this is that regardless of the time it holds true across all the markets.

The trading concepts used by William Delbert Gann, or W.D. Gann as he is fondly called, bring feelings of intrigue and mystique.

He is primarily known for his market forecasting abilities, such as the Gann square of nine which combine a mix of geometry, astrology, and ancient math techniques. Gann started trading at the age of 24 and was a religious man.

Gann was also a 33rd degree Freemason to which some attribute his knowledge of mathematics and ratios.

William Delbert Gann is perhaps the most mysterious of all the famous traders in history. Known for using geometry, astrology and ancient mathematics to predict events in the financial markets and historical events, Gann’s trading strategies are still widely used today, long after his death in 1955.

For the most part, Gann’s works have been open to interpretation. Therefore, to trade based on Gann’s methods requires extensive practice and understanding.

All traders are looking for that edge. As individual retail traders, we’re competing against the best minds, the most experienced and skilled traders in the world. If you looked at it logically, they hold all the cards, they have a big-brother view of what’s going on in the markets every minute of the day. Does this mean we don’t stand a chance? Not at all – we just need to be a little bit creative sometimes with our trading systems and we can beat them at this game.

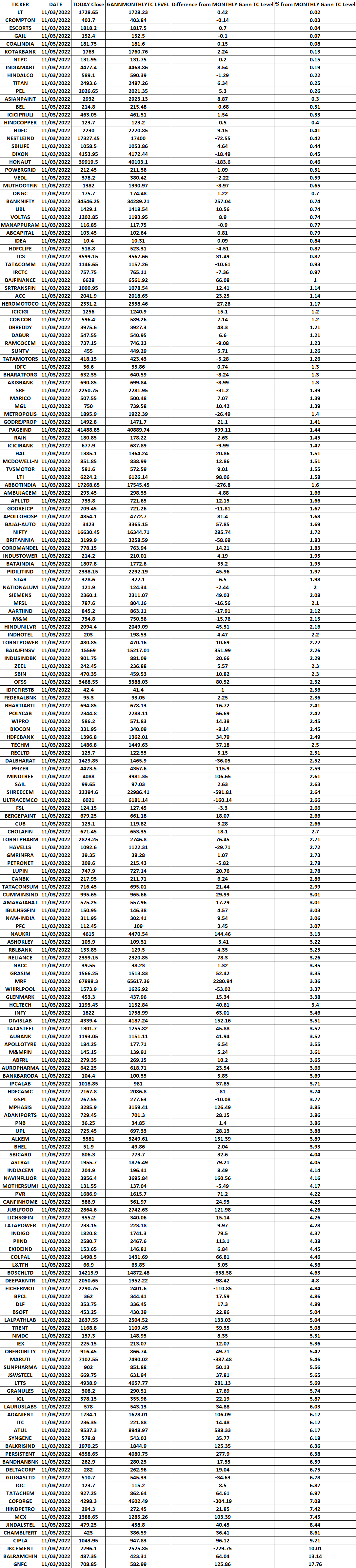

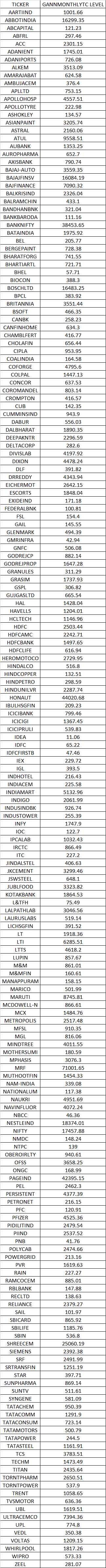

I have made my Gann Monthly Trend Change scanner which covers all FNO Stocks.

How to Trade

- Levels are Valid from 10-March 2022 till 09-April 2022

- Wait for Price to come near the levels

- Once the price is near to level watch for 5 mins candel close.

- If Close above it Take trade with 1% as SL in Stocks 50 Points in Nifty and 108 Points in Bank Nifty.

- Target for Stocks 5% than TSL Nifty 125 points and TSL Bank NIfty 333 points and TSL

- ANy given Day SL gets triggred 2 time no further trade

- We have explained below Video with 1 Eg on Nifty Bank nifty and Auropharma

- Stay Disciplined and Trade with Right Position Size.

For Back Testing Sharing Levels for Febuary Month

how can we calculate these levels on monthly basis, kindly teach the method of such calculations

Thanks covered in our trading course