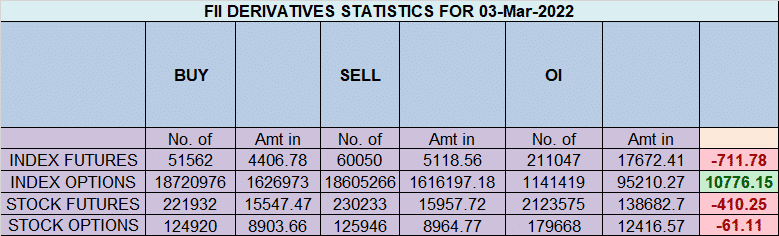

FII sold 8.4 K contract of Index Future worth 711 cores, Net OI has increased by 18 K contract 4.7 K Long contract were covered by FII and 13.2 K Shorts were added by FII. Net FII Long Short ratio at 0.81 so FII used fall to enter long and enter short in Index Futures.

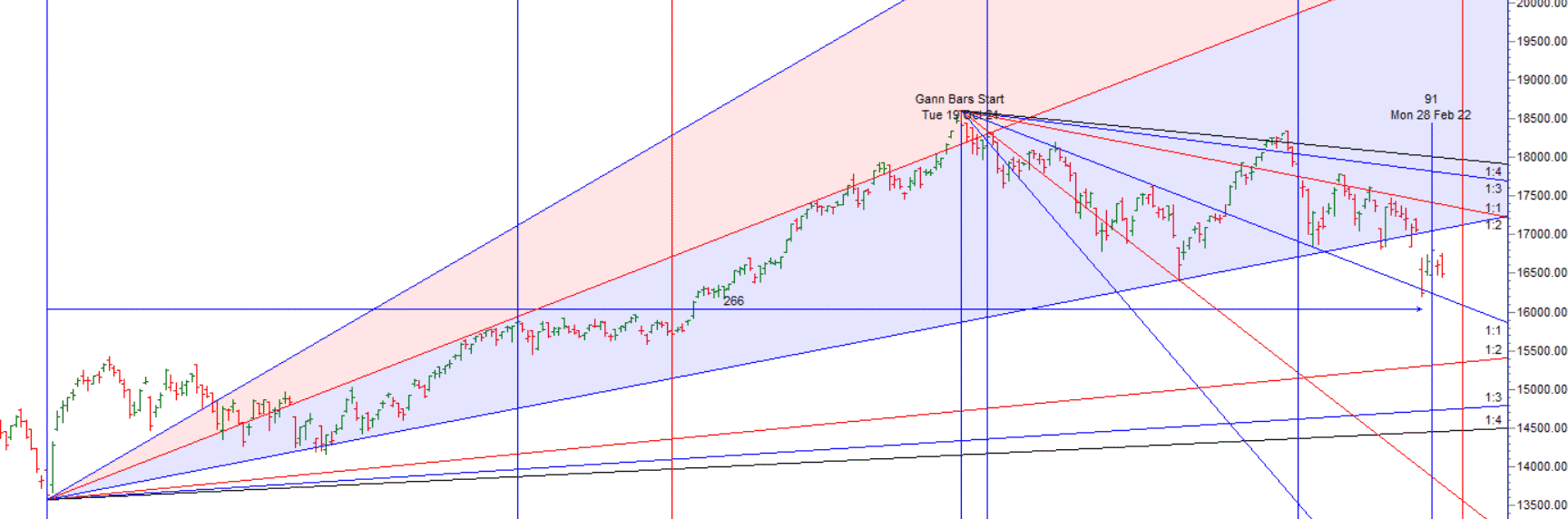

As discussed in last analysis We have very important Bankruptcy Aspect tommrow Venus Conjucnt Pluto as discussed in below video, Watch for first 15 mins High and low to get the trend of the market. Follow the levels with discipline and rewards will be seen. For Swing Traders Long should be taken above 16621 for a move towards 16686/16751. Bears will get active below 16556 for a move towards 16491/16426. Below 16556 we got 16491 and 15 mins low broken and whole day we got a downmove and we also formed Daily Outside bar pattern. Tommrow we have Lunar Cycle and Multiple Ingress on 06 March which should bring some big move in bank nifty. Above 16518 Bulls can see move towards 16575/1663. Bears below 16445 will see a quick fall towards 16380/16315/16251.

Intraday time for reversal can be at 9:51/10:49/11:16/12:53/1:23/2:27 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16500 PCR at 0.92 , Rollover cost @16997 closed below it.

Nifty March Future Open Interest Volume is at 1.26 Cores with addition of 1 Lakh with increase in cost of carry suggesting SHORT positions were added today.

Talking about supports and resistance based on OI at this stage is not quite relevant because, with the kind of Voaltality going on, no strike is safe as 1 day we are down 300 points and other day 300 point up.The option table is undergoing a real transformation – with each day one CE level is targeted with huge volumes of writing and the strike is giving way to much lower strikes.

The VIX is still standing at a very high value – causing concern to the option writers. Buying options at these high premiums is not a good way of trading.

With the staunch support of Ukraine from the globe driving a unification of Western interests to confront the Russian threat – an outcome most wouldn’t have envisaged–combined with Ukrainian resolve, there is a more likely outcome of a ceasefire orchestrated by Russia as today’s headlines suggested, which creates an early ‘off ramp’ for the conflict and easing of oil prices. This same point also has helped to lower the concern of a near-term China invasion of Taiwan.

FII’s sold 6644 cores and DII’s bought 4799 cores in cash segment.INR closed at 76.14

For Positional Traders Stay long till we are holding Trend Change Level 16589 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16591 will act as a Intraday Trend Change Level.

ultimate