FII bought 1.2 K contract of Index Future worth 79 cores, Net OI has increased by 8.7 K contract 4.9 K Long contract were added by FII and 3.7 K Shorts were added by FII. Net FII Long Short ratio at 1.20 so FII used fall to enter long and enter short in Index Futures.

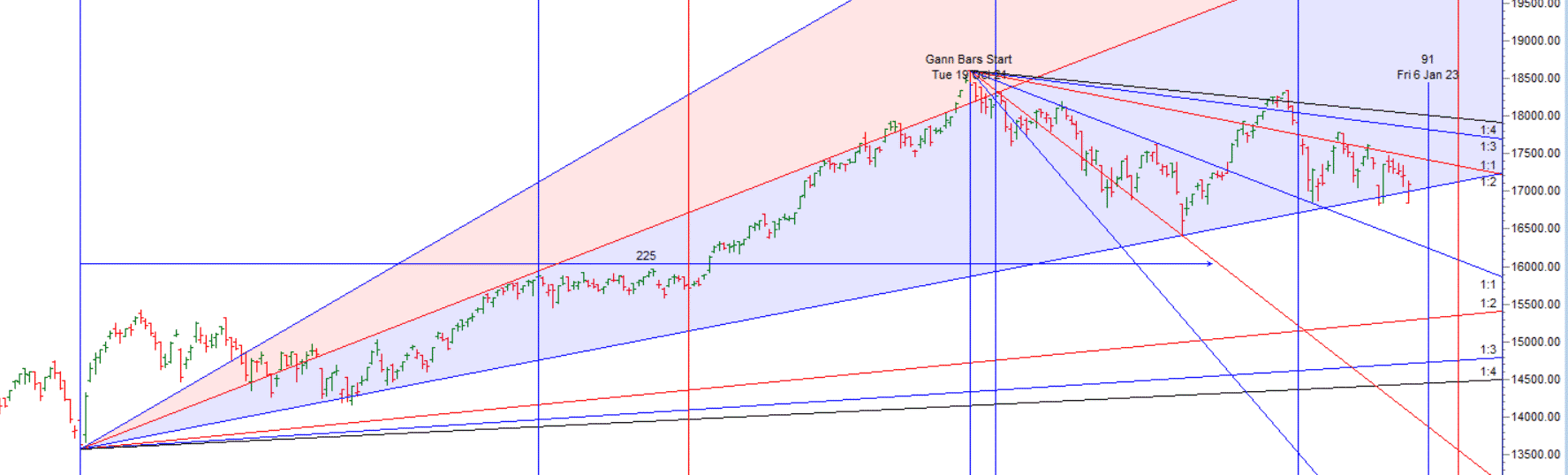

As discussed in Last Analysis Again a gap down open and intraday recovery tommrow we have 2 important Astro event Moon at Descending Node and Venus at Extreme Declination suggesting note down first 15 mins High and Low and take trade accordingly. We are back to magic 1×1 Gann line as discused in below video, For Swing Traders Long above 17133 for a move towards 17198/17263/17328. Bears will get active below 17069 for a move towards 17004/16939. Today High and low will be important for swing trade till Friday based on Astro event today. For Swing Traders Long above 17124 for a move towards 17198/17250. Bears will get active below 16987 for a move towards 16911/16800

Intraday time for reversal can be at 9:51/11:10/12:19/1:17/2:26 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17100 PCR at 0.95 , Rollover cost @17295 closed below it.

Nifty Feb Future Open Interest Volume is at 0.56 Cores with liquidation of 20 Lakh with decrease in cost of carry suggesting LONG positions were closed today.

The Option Table data indicates decent support at 17000 and reasonable resistance at 17200. There is total OI of 9.46 Cores on the Call side and 6.93 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

The critical quality needed to make money in this kind of market, where trends will flip on no notice is: Extreme flexibility Be prepared to flip your positions and trades with market flavour.It is always the minority which wins in the markets. So, be open for possibilities.

Retailers have bought 553 K CE contracts and 427 K CE contracts were shorted by them on Put Side Retailers bought 168 K PE contracts and 205 K PE contracts were shorted by them suggesting having BULLISH outlook,On Flip Side FII bought 75.7 K CE contracts and 31 K CE were shorted by them, On Put side FII’s bought 48 K PE and 19.4 K PE were shorted by them suggesting they are still having to BEARISH Bias

FII’s sold 3417 cores and DII’s bought 3024 cores in cash segment.INR closed at 74.89

For Positional Traders Stay long till we are holding Trend Change Level 17059 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17141 will act as a Intraday Trend Change Level.