FII bought 5 K contract of Index Future worth 426 cores, Net OI has decreased by 1.3 K contract 1.8 K Long contract were added by FII and 3.1 K Shorts were covered by FII. Net FII Long Short ratio at 0.63 so FII used rise to ENTER Longs and ENTER Shorts.

Nifty formed a Hmmer Pattern saw a decent rally from bottom Now Bulls need to move above 17304 for a move back to 17370/17435/17500. Bears below 17225 can see quick fall towards 17174/17108/17043. We have seen effect of Mars aspect with Huge volatality in the market. Bulls need to close above 17304 for short term bottom confirmation.

Intraday time for reversal can be at 10:14/11:08/12:34/2 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17300 PCR at 0.83, Rollover cost @17295 closed below it.

Nifty Feb Future Open Interest Volume is at 0.93 Cores with liquidation of 5.7 Lakh with decrease in cost of carry suggesting SHORT positions were closed today.

There is total OI of 6.02 Cores on the Call side and 5.83 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

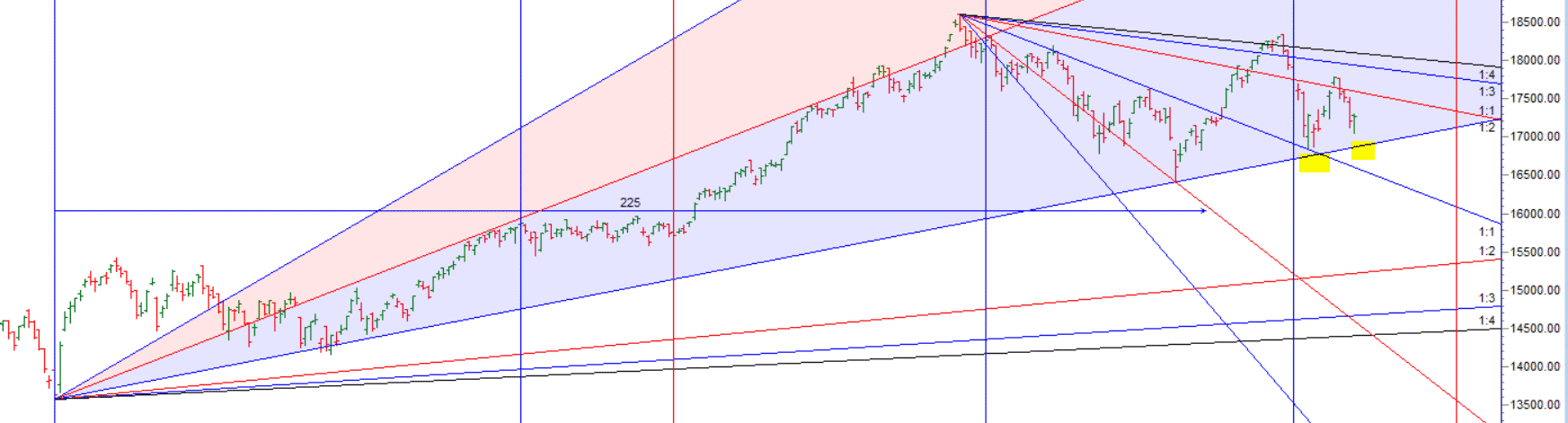

As per Gann,Bulls need to move above 17325 for any bullish move else all rallies will get sold into.

Retailers have sold 24 K CE contracts and 3.6 K shorted CE contracts were covered by them on Put Side Retailers bought 213 K PE contracts and 195 K PE contracts were shorted by them suggesting having BEARISH outlook,On Flip Side FII bought 25 K CE contracts and 17.3 K CE were shorted by them, On Put side FII’s bought 27.8 K PE and 14.7 K shorted PE were covered by them suggesting they have a turned to BULLISH Bias

The Option Table data indicates decent support at 17100 and reasonable resistance at 17400 .

FII’s sold 197 cores and DII’s bought 1115 cores in cash segment.INR closed at 74.88.

For Positional Traders Stay long till we are holding Trend Change Level 17410 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17200 will act as a Intraday Trend Change Level.

Good Level sir @ Nifty

Thanks !!