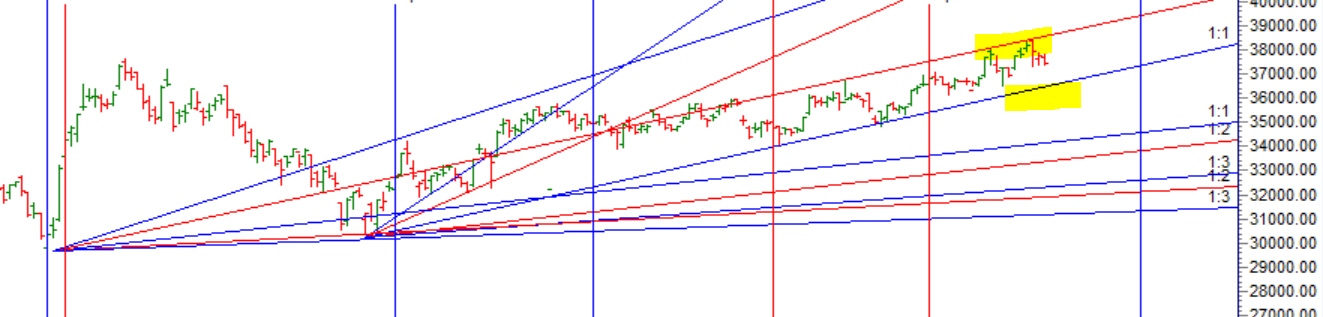

As discussed in Last Analysis As we have expiry tommrow and Half yearly closing also last hour should be volatile. Now Bulls need to move above 37758 for a move towards 37855/37953/38050. Bears will have chance below 37631 for a move towards 37535/37438/37341. Bulls were able to do 1 target on upside and bears did all target on downside, We are still trading with in 29 Sep range when we had important astro date. Bears need to break 37303 for a quick 37110/36826/36666. Bulls need to move 37644 for a move towards 37741/7839/37936/38033.

- Intraday time for reversal can be at 9:42/11:26/12:36/1:22/2:09/2:48 How to Find and Trade Intraday Reversal Times

- Bank Nifty Oct Future Open Interest Volume is at 20.9 lakh with addition of 6.8 Lakh contract , with decrease in Cost of Carry suggesting SHORT positions were added today.

- There has been 6.8 L contract roll-over happened today. When you add 6.7 L contracts rolled over yesterday, we have 12L contracts have been rolled over between 38500-37850 price zone. Considering that we are having around 20 OI this is approximately 50%. So, this price zone will have a crucial bearing in the October series. Rollover Price is at 37993 and Rollover % @ 80.7 on Higher Side

- MAX Pain is at 37500 PCR at 0.8.

- The Option Table data indicates decent support at 37000 and reasonable resistance at 38000.

- For Positional Traders Stay long till we are holding Trend Change Level 37770 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 37770 will act as a Intraday Trend Change Level.

Sir jitna aap likhte ho iska matlab bhi kisi video mein samjha do toh thoda jyada easy ho jayega hum jaise logo ke liye

Thank you for your time and guidence guru ji.