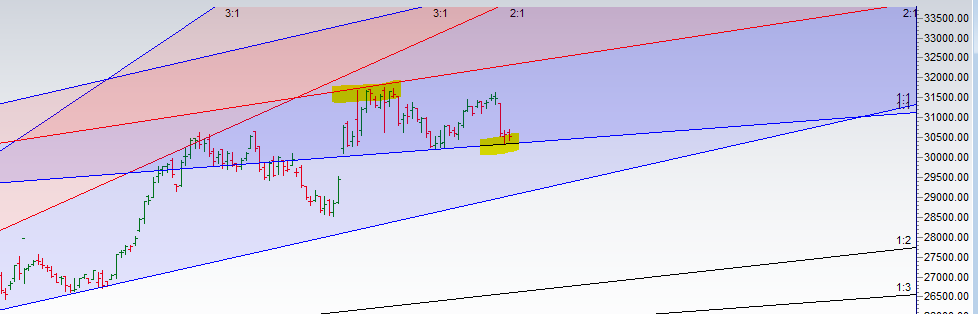

- As Discussed in Last Analysis Bulls will become active above 30672 for a move towards 30816/30960. Bears will become active below 30340 for a move back to 30240/30150/30000. Bank Nifty bulls again got whipsawed but held on to gann angle. We have important time cycle date tomorrow and Weekly Expiry.Bulls will become active above 30610 for a move towards 30721/30816/30960. Bears will become active below 30340 for a move back to 30240/30150/30000.

- Intraday time for reversal can be at 10:19/12:02/1:25/2:36 How to Find and Trade Intraday Reversal Times

- Bank Nifty July Future Open Interest Volume is at 17.7 lakh with liquidation of 033 Lakh, with decrease in Cost of Carry suggesting short positions were closed today. Bank nifty Rollover cost @31207 closed below it and big fall.

- 31000 CE is having highest OI @2.63 Lakh resistance at 31000 followed 31500. 30000-32000 CE added 2 Lakh in OI so bears added position in the zone of 31000-31500.

- 30000 PE is having highest OI @2.55 Lakh, strong support at 30500 followed by 30300.30000-32000 PE liquidated 0.16 Lakh OI so bulls making strong support in the range of 30300-30500.

- Bank Nifty Futures Trend Deciding level is 30581 (For Intraday Traders). BNF Trend Changer Level (Positional Traders)31225 How to trade Nifty Futures and Bank Nifty Futures as per Trend Cha31388 nger Level .

Buy above 30610 Tgt 30695,30783 and 30870 (Bank Nifty Spot Levels)

Sell below 30433 Tgt 30346,30259 and 30150 (Bank Nifty Spot Levels)

Upper End of Expiry: 30739

Lower End of Expiry: 30304

Follow on Twitter:https://twitter.com/brahmesh

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ