- FII’s sold 10.9 K contract of Index Future worth 702 cores 11.5 K Long contract were liquidated by FII’s and 580 Short contracts were liquidated by FII’s. Net Open Interest decreased by 12.1 K contract, so fall in Nifty was used by FII’s to exit long and exit short in Index futures.FII’s Long to Short Ratio at 1.28. How Comfortable you are with your trading ?

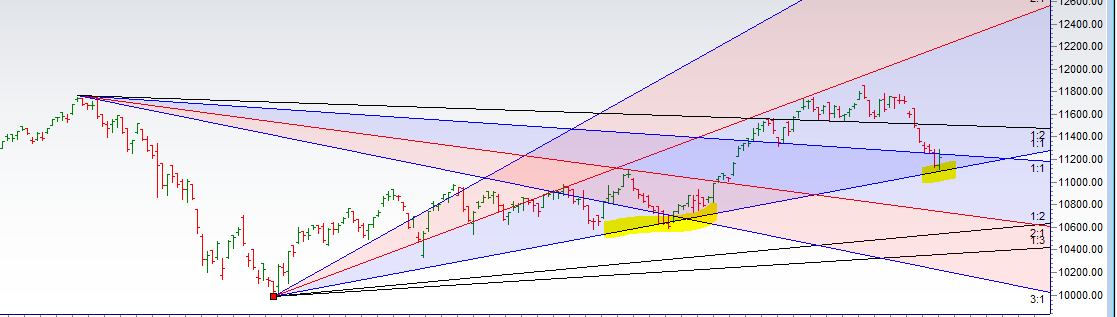

- As Discussed in Last Analysis Nifty did bounce back from 11222 but failed to do target on upside and once 11197 was broken bears got an upper hand waiting for the downside target of 11060/11000/10927. Nifty took support at 11100 and level mentioned on twitter worked perfectly and we were able to ride the whole move, Next few days will be volatile as election based news will drive the market so trade less and trade better, Today we have bounced from gann angle and for trend reversal to take place we need to see a close above 11300. Also we have important astro event lined up for next 2 days as discussed in below video. Bulls will get active above 11243 for a move towards 11295/11343/11400. Bears will get active below 11197 for a move back to 11100/11030/10930. THE MOST NEGLECTED TRADING DISCIPLINE

- Important intraday time for reversal can be at 10:06/12:04/2:35 How to Find and Trade Intraday Reversal Times

- Nifty May Future Open Interest Volume is at 1.62 core with liquidation of 7.7 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @11742,closed below it.

- Total Future & Option trading volume at 10.68 Lakh core with total contract traded at 1.80 lakh , PCR @0.85

- 11500 CE is having Highest OI at 12 Lakh, resistance at 11400 followed by 11500 .11000-11800 CE added 4.5 Lakh in OI so bears added position in range of 11300-11500. FII bought 2.7 K CE and 15.4 K CE were shorted by them. Retail sold 35 K CE and 38 K shorted CE were covered by them.

- 11000 PE OI@26.2 Lakhs having the highest OI strong support at 11100 followed by 11000 . 11000-11600 PE added 0.27 Lakh in OI so bulls added small position in range 11200-11300 .FII sold 2.5 K PE and 5.1 K PE were shorted by them. Retail bought 106 K PE and 67.2 K PE were shorted by them.

- FII’s sold 2011 cores and DII’s bought 2242 cores in cash segment.INR closed at 70.47 Usd to Inr – Dollar to Rupee Forecast for Next Week

- Nifty Futures Trend Deciding level is 11228 For Intraday Traders). NF Trend Changer Level (Positional Traders) 11567 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11243 Tgt 11266,11295 and 11323 (Nifty Spot Levels)

Sell below 11197 Tgt 11166,11144 and 11122 (Nifty Spot Levels)

Follow on Twitter:https://twitter.com/brahmesh

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ