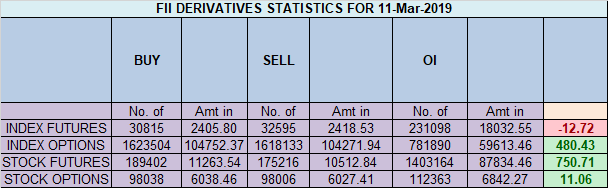

- FII’s sold 1.7 K contract of Index Future worth 12 cores 6.4 K Long contract were added by FII’s and 8.2 K Short contracts were added by FII’s. Net Open Interest increased by 14.7 K contract, so rise in Nifty was used by FII’s to enter long and enter short in Index futures.FII’s Long to Short Ratio at 1.07. Emotions and Intraday Trading

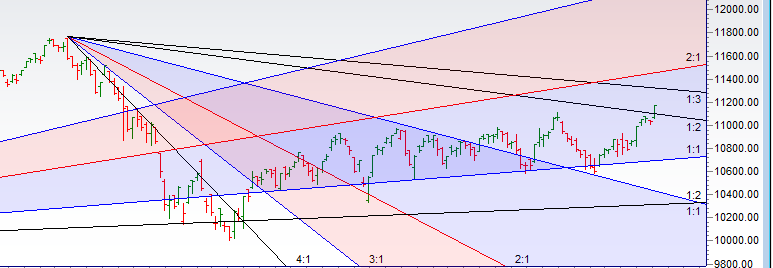

- As Discussed in Last Analysis We have Important Astro date on 08 Mar and 09 Mar is Gann 10 Year Cycle so expect good move in next 2 trading sessions.Now Bulls need to continue holding 11000 for up move to continue towards 11111/11177/11230. Time Cycle gives an additional edge, We did not know that election Dates will be announced on Sunday but time cycle kept us above the fold and we were able to capture the move till 11177 now waiting for 11230-11236 where major supply zone lies above which can see move towards 11300/11376. Bearish below 11099 for a move towards 11030/10985.

- Important intraday time for reversal can be at 10:18/1:41 Bank Nifty Technical near Gann 10 Year Cycle Date

- Nifty March Future Open Interest Volume is at 1.55 core with addition of 9.2 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @10868 closed above it,rallied 350 points

- 11400 CE is having Highest OI at 22.4 Lakh, resistance at 11300 followed by 11400 .10400-11200 CE added2.9 Lakh in OI so bears added position in range of 11300-11400. FII bought 19.6 K CE and 5 K CE were shorted by them. Retail bought 24 K CE and 18.8 K CE were shorted by them.

- 11000 PE OI@ 37.8 Lakhs having the highest OI strong support at 11000 followed by 10900 . 10500-11000 PE added 14.8 Lakh in OI so bulls covered position in range 10900-11000 PE.FII sold 4.8 K PE and 4.2 K PE were shorted by them. Retail bought 145 K PE and 94.7 K PE were shorted by them.

- Total Future & Option trading volume at 6.79 Lakh core with total contract traded at 1.13 lakh , PCR @0.87

- FII’s bought 3810 cores and DII’s sold 1955 cores in cash segment.INR closed at 69.89 DOLLAR TO RUPEE – USD TO INR FORECAST

- Nifty Futures Trend Deciding level is 11168 For Intraday Traders). NF Trend Changer Level (Positional Traders) 11016 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11180 Tgt 11200,11225 and 11250 (Nifty Spot Levels)

Sell below 11125 Tgt 11110,11085 and 11055 (Nifty Spot Levels)

Follow on Twitter:https://twitter.com/brahmesh

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ