Stock markets are all about ‘sentiments’, and elections play a key role in shaping the sentiments. In elections, political parties with widely different political and economic agendas clash. There is always slight fear making a home in the minds of the investors if the party being elected can be positive or negative to some businesses. Even the changes in economic views and strategies of same government or even ministers can change business prospects of different segments of the economy. Furthermore, there is fear in the stock markets that economic policies being executed up till now by the ruling party may stand changed if the new government arrives at the scene. It leads to a spike in market volatility and uncertainty rules the roost during this time period. The more voters feel confused about who the clear winner will be, the more stock markets are affected by this volatility.

For Bank Nifty Analysis on Election Day Watch this Video https://www.youtube.com/watch?v=5VTjUA0CPnY

4 State Election Results 2013

Conclusion: Market was rising in anticipation of BJP Victory,Once results were out We made Top, Classic Scenario of Buy Rumor Sell News

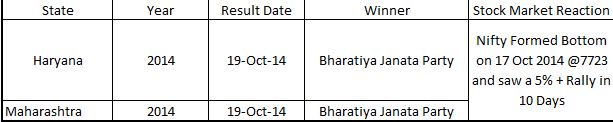

Haryana and Maharashtra Election Results 2014

Conclusion: Market was not sure of outcome was in small corrective mode BJP Victory in Both Election ,Once results were out We made Bottom and rallied for more than 5%.

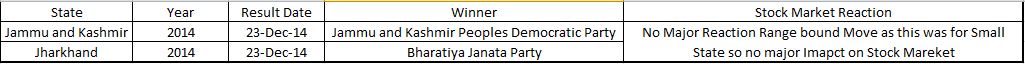

Jammu and Kashmir and Jharkhand Election Results 2014

Conclusion: No Major Reaction Range bound Move as this was for Small State so no major Impact on Stock Market

Delhi Election Results 2015

![]()

Conclusion: Results were beyond Market expectation, It was a clean Sweep of AAP. Bottoms are made on bad news Short Term Bottom Formed and 5% +Rally in 6 Days