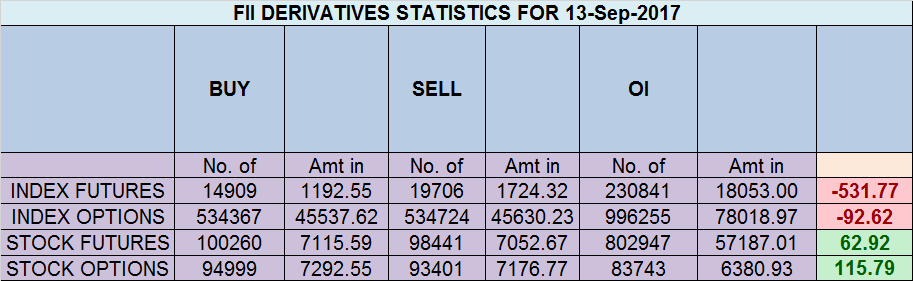

- FII’s sold 4.7 K contract of Index Future worth 531 cores ,4.4 K Long contract were added by FII’s and 9.2 K Short contracts were added by FII’s. Net Open Interest increased by 13.7 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 1.46. Build up your confidence as a trader

- As discussed in last analysis Time Cycle did the effect with nifty rallying 100 points but failed to cross the main hurdle of 10030, Bulls need close above 10030 for a march towards 10090/10157/10250. Bearish below 9930 only. Low made was 10030 and high made was 10097 so bulls finally did breakout once the time cycle turn in favour and did 10090 now holding 10030 bulls can rally all the way towards new high of 10137 and 10200. High made today was 10132 missed the life high by 5 points but still held on to 10030 after last 1 hour of volatility, till we are holding 10030 another attempt will be made towards new life highs and ultimate move towards 10250 which is an important gann resistance, Bearish below 10030 for a move towards 9970/9930/9870. Bank Nifty Held to Gann Line amid Volatility,EOD Analysis

- Nifty September Future Open Interest Volume is at 2 core with addition of 5.8 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @9910 Closed above it.

- Total Future & Option trading volume at 6.58 Lakh core with total contract traded at 0.94 lakh , PCR @0.99

- 10200 CE is having Highest OI at 41.2 Lakh, resistance at 10200 followed by 10100 .9500-10500 CE added 9.8 Lakh in OI so bears added major position in range of 10100-10200 CE. FII sold 6.1 K CE and 326 shorted CE were covered by them. Retail bought 35.9 K CE and 11.6 K CE were shorted by them

- 9900 PE OI@60.6 lakhs having the highest OI strong support at 9900 followed by 9800. 9900-10500 PE added 15 Lakh in OI so bulls added position in 9900-10300 PE,making strong base at 9900. FII bought 5.3 K PE and 10.7 K PE were shorted by them. Retail bought 92.9 K PE and 52.4 K PE were shorted by them

- FII’s sold 826 cores and DII’s bought 725 cores in cash segment.INR closed at 63.99

- Nifty Futures Trend Deciding level is 10111 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9984. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10090 Tgt 10120,10142 and 10187 (Nifty Spot Levels)

Sell below 10070 Tgt 10048,10025 and 10000 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh