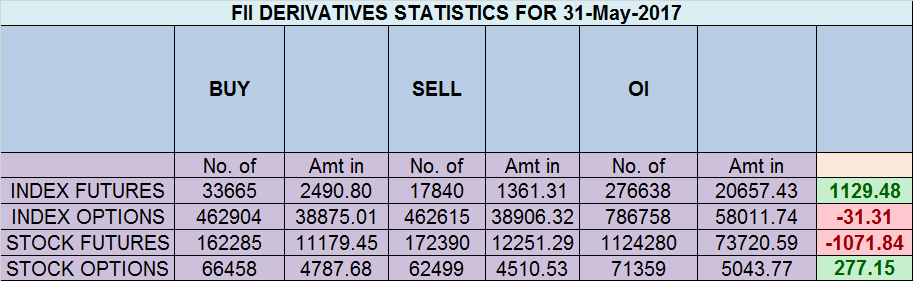

- FII’s bought 15.8 K contract of Index Future worth 1129 cores ,14.4 K Long contract were added by FII’s and 1.3 K Short contracts were liquidated by FII’s. Net Open Interest increased by 13 K contract, so rise in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 6 How I Deal with Trading Losses

- As discussed in last analysis As we have monthly close tomorrow bulls have upper hand, above 9637 we can see fast move towards 9669/9700. Bearish below 9570 for a move towards 9500. As we approach the monthly closing tomorrow which is also gann pressure date good move can be seen in next 2 days. Nifty moved above 9637 but failed to move towards 9669 but closed was again 9610 suggesting balls is in bull court, but facing lot of resistance at gann angle, Bigger the size of index becomes the more time and energy it takes to move it. Till we are above 9610 we can move towards 9669/9700/9767. Bearish below 9570 for a move towards 9500. Prices cannot stay near gann angles for so long so brace for a trending move. Bank Nifty continue to move higher holding gann angle

- Nifty June Future Open Interest Volume is at 2.18 core with addition of 10.7 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @9435 Closed above it.

- Total Future & Option trading volume at 4.47 Lakh core with total contract traded at 0.88 lakh , PCR @0.92

- 9700 CE is having Highest OI at 43.9 lakh, resistance at 9650 followed by 9700 .9200-9700 CE added 6.6 K Lakh in OI so bears added position in 9600-9700 CE. FII bought 417 CE longs and 12.6 K CE were shorted by them.Retail bought 28 K CE contracts and 15.5 K CE were shorted by them.

- 9400 PE OI@57 lakhs having the highest OI strong support at 9500 followed by 9400. 9300-9700 PE added 22.4 Lakh in OI so bulls added aggressively in 9300-9400 PE . FII bought 21.1 K PE and 8.7 K PE were shorted by them. Retail bought 59.1 K PE contracts and 40.5 K PE were shorted by them.

- FII’s bought 1049 cores in Equity and DII’s sold 939 cores in cash segment.INR closed at 64.51

- Nifty Futures Trend Deciding level is 9624 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9564. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9627 Tgt 9645,9667 and 9685 (Nifty Spot Levels)

Sell below 9600 Tgt 9585,9560 and 9540(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

“FII’s Long to Short Ratio at 6”.

SIR, Is this a new indicator? Any analysis on this? Also the significance.

Thanx