Last Week we gave Chopad Levels of 9101, Nifty gave Short entry on Monday which did 1 target on Downside. Long was triggered by Tuesday did 1 Tgt on Thursday thus both bulls and bears were rewarded following Chopad levels. Lets Analyze how to trade Nifty as we are approach the New Financial Year. Trading Resolution for Financial Year 2017-18

Nifty Hourly Chart

As discussed in last analysis Hourly chart was near the support line as shown in above chart and should see impulsive move towards 9200 holding 9077

High made was 9192 so we almost did 9077 above 9077. Now for coming week break of 9200 can see fast move towards 9268/9312/9368. Bearish below 9130 for a move towards 9060/8992

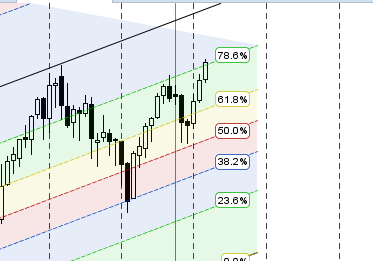

Nifty Harmonic

Still waiting for 9312 for completion of extended abcd pattern.Bulls needs to hold 8992 for the target to come.

Nifty Gann Angles

Bulls should hold 9130 for a the move towards 9312/9468.

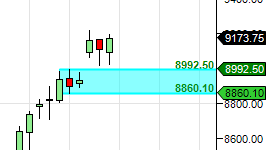

Nifty Supply and Demand

Bulls should now hold 8992 for march towards 9312/9468.

Nifty Gann Date

Nifty As per time analysis 03 April is Gann Turn date , impulsive move can be seen around these dates.

Nifty Weekly Chart

It was positive week, with the Nifty up by 66 points closing @9173 and continue to close above the next quadrant as in above chart and closing above 9100. Holding above 9077 we can see move towards 9300/9500. As discussed in last analysis Next time cycle start from 27 March till 04 April. Till 9020 is held cycle will remain positive. Low made 9024 and we are up 170 points from that. As per time cycle expect a big move in next 2 weeks. Bulls should hold 9100 for time cycle to be bullish else bearish will take the game and push nifty towards 9020/8969.

Trading Monthly charts

Bulls need to hold 8992 on Monthly closing basis for next move towards 9600/10200 in next 6 months.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:9166

Nifty Resistance :9235,9300,9368

Nifty Support :9120,9070,8992

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh