Professional traders are always in search of levels where the price moves swiftly in either side so that they make a right entry and exit the trade profitably. Today we will discuss Camarilla Point trading strategy has an astounding accuracy with respect to day trading and will be helpful to professional traders who have prior knowledge of Support, Resistance, Pivots etc. Camarilla Pivot points was discovered by Nick Scott in 1989, a successful bond trader. His basic thesis for the Camarilla Pivot was most time series have a tendency to revert to mean.

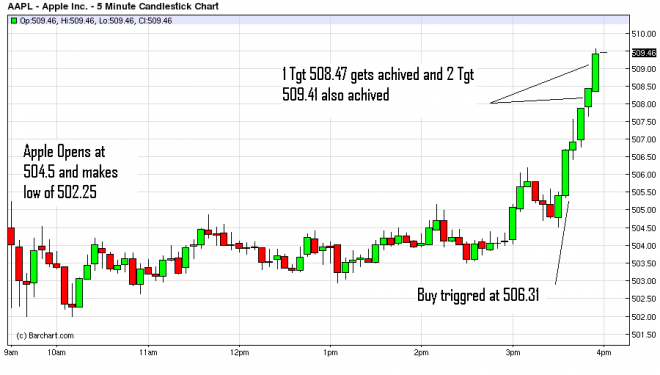

As compared to classic pivots where traders look for Resistance 1 and support 1, for the Camarilla Pivot points most important to traders are third and fourth levels of Support and resistances as shown in below chart.

How to Calculate Camarilla Pivot Points

Let’s discuss the calculation involved in generating Camarilla Pivot points. We need to Input previous days Open, High, Low and Close to generate the Camarilla Levels ie. Resistances(R1 to R4) and Supports (S1-S4) .Formulae Involved are as mentioned below

R4 = Close + (High – Low) * 1.1/2

R3 = Close + (High – Low) * 1.1/4

R2 = Close + (High – Low) * 1.1/6

R1 = Close + (High – Low) * 1.1/12

S1 = Close – (High – Low) * 1.1/12

S2 = Close – (High – Low) * 1.1/6

S3 = Close – (High – Low) * 1.1/4

S4 = Close – (High – Low) * 1.1/2

Moving above R4 and below S4 if and when it happens the stock generally gives a good trending move or breakout moves towards R5 and R6 on Upside and S5 and S6 on downside. They can be determined with the below mentioned formulae.

R5 = R4 + 1.168 *(R4-R3)

R6 = (High/Low)* Close

S5 = S4 – 1.168 *(S3-S4)

S6 = Close – (R6 – Close)

Traders can use this Link to Generate Camarilla Pivot Points http://pivotpointscalculator.blogspot.in/

How to trade using Camarilla Pivot Points

As we have discussed How to generate Camarilla Pivot points now let’s discuss how can we trade using them in the next Article

Why there is a difference between the calculation of R6 and S6? Is it a typographical error?

Typo error..