- FII’s bought 11.2 K contract of Index Future worth 709 cores ,9.3 K Long contract were added by FII’s and 1.9 K short contracts were liquidated by FII’s. Net Open Interest increased by 7.4 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures.

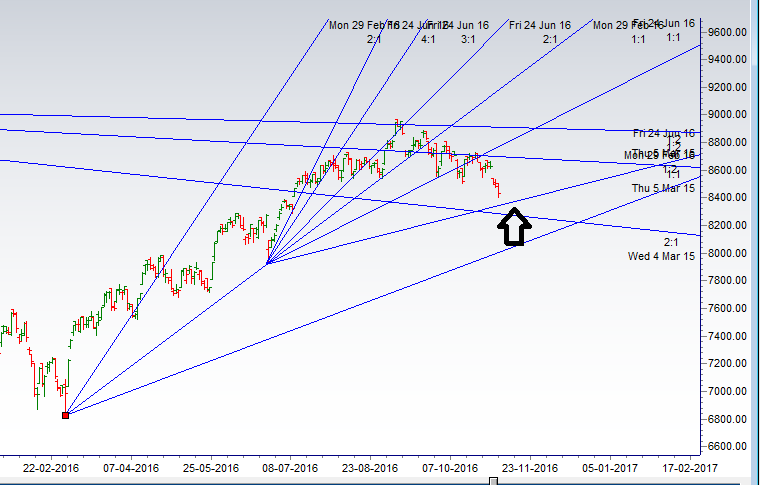

- Below Gann Analysis Chart has been discussed in Weekly Analysis We saw the gap down opening below 8448 on overnight events of Surgical Strike on Black Money and Donald becoming President which most of traders should have been able to capitalized as Trend Changer level triggered shorts yesterday and also as per gann analysis closed below 8550 overnight shorts were rewarded if booked. Profit Booking also plays a very crucial role in trading. Traders who missed shorts using the Gann Analysis traders should have been able to capture the bottom and the massive rally of 400 points, On Hindsight looks good but taking decision in live market can only be possible when you TRUST your system and very very strong in your risk and money management, Bulls need a close above 8487 for a move towards 8600/8737. Bears will get active below 8400 for a fast move towards 8287/8100.

- Nifty Nov Future Open Interest Volume is at 1.60 core with liquidation of 0.57 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8705 made high at 8704 on Tuesday and correction of 300 points.

- Total Future & Option trading volume was at 7.82 Lakh core with total contract traded at 4.5 lakh , PCR @0.93.

- 9000 CE is having Highest OI at 58.5 lakh, resistance at 9000 .8500/9000 CE liquidated 14 lakh so bears ran for cover 8600/8800 PE .FII bought 6.3 K CE longs and 9.8 K CE were shorted by them .Retail bought 21.2 K CE contracts and 21 K shorted CE were covered by them.

- 8200 PE OI@56.5 lakhs having the highest OI strong support at 8200 followed by 8300. 8200-8700 PE liquidated 25 Lakh in OI so bulls for ran for cover in 8200-8300. FII bought 25.2 K PE longs and 13.9 K PE were shorted by them .Retail bought 19.5 K PE contracts and 542 PE were shorted by them.

- FII’s sold 2095 cores in Equity and DII’s bought 1116 cores in cash segment.INR closed at 66.60

- Nifty Futures Trend Deciding level is 8306 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8552,shorts got triggered yesterday were rewarded handsomely . How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8450 Tgt 8487,8520 and 8560 (Nifty Spot Levels)

Sell below 8400 Tgt 8375,8350 and 8320 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

“NF Rollover cost @8705 made high at 8704 on Tuesday and correction of 300 points”..may i ask what this would mean?

Means Nifty was not able to close above Rollover range and corrected

Ati uttam Sir ji 😉

thanks..