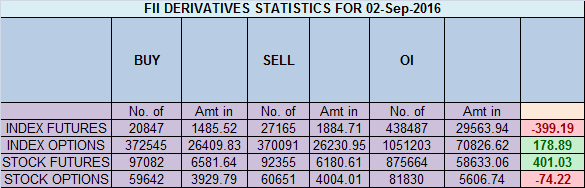

- FII’s sold 6.3 K contract of Index Future worth 399 cores ,4.6 K Long contract were liquidated by FII’s and 1.6 K short contracts were added by FII’s. Net Open Interest decreased by 3 K contract, so rise in market was used by FII’s to exit long and enter shorts in Index futures. Do Not Limit Yourself

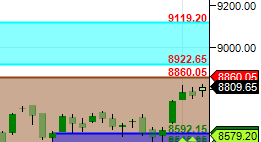

- As discussed in Yesterday Analysis Bulls above 8723 can see move till 8851/8900. 8851 should mostly be achieved by Tuesday bit than comes the tricky range of 8860-8922 range where bulls will again face lot of supply pressure, once croossed and close above 8922 we can see a fast move towards a new all time high. Bears have there chance only below 8600. Bank Nifty heading towards 20500, EOD Analysis

- Nifty Sep Future Open Interest Volume is at 3.31 core with liquidation of 4.5 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @8686, closed above it.

- Total Future & Option trading volume was at 2.09 Lakh core with total contract traded at 0.95 lakh , PCR @1.33 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 60.3 lakh, resistance at 9000 .8500/9000 CE liquidated 0.1 lakh so resistance formation in 8850-8900 zone seeing sign of crack .FII bought 2 K CE longs and 4.6 K CE were shorted by them .Retail bought 15.4 K CE contracts and 10.2 K shorted CE were covered by them.

- 8600 PE OI@69.7 lakhs having the highest OI strong support at 8600. 8300-8800 PE added 12.4 Lakh in OI so bulls making strong base near 8600-8650 zone .FII bought 13.7 K PE longs and 8.7 K PE were shorted by them .Retail bought 40.4 K PE contracts and 32.7 K PE were shorted by them.

- FII’s bought 231 cores in Equity and DII’s bought 134 cores in cash segment.INR closed at 66.96

- Nifty Futures Trend Deciding level is 8820 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8736 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8833 Tgt 8856,8889 and 8920 (Nifty Spot Levels)

Sell below 8795 Tgt 8777,8750 and 8620 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Sir

Please explain correlation of rsi,sma ,ema,macd, with any stock in terms of bullish and bearish view.what is meant by number say 3,4 or7,8.on the scale of 1 to 10.

Eagerly wait for your say daily by 8.30 a.m.

As a trader we should conc on trading system rather than looking at individual technical parameter…

Dear Ramesh,

Do we need to use log scale or linear scale. Consider 6826 to 7992 as first wave in Nifty (also 100% retracement of last fall) . 161.8% comes to around 8730 if we use linear scale; and 8820 if we use log scale. Also referred your article on Harmonic pattern. If we use linear scale then it is break out to 100% retracement from 8730. This quite different view when use log scale. Kindly provide your expertise here,

Regards

I use log scale for my analysis..

“8850-8900 zone is seeing sign of crack” does it mean nifty will go above the level or nifty will crash from this level pls explain sirji

yes sir

Karn, He meant, it’s unlikely to go above that level easily.High chances of some kind of reversal in that range.. which might be on opening today.