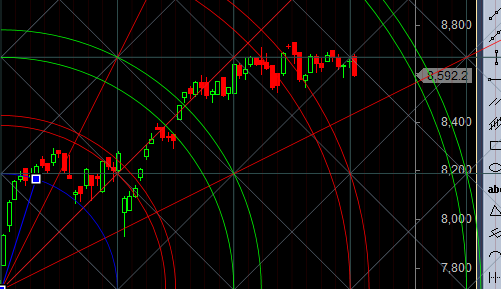

- As discussed in Yesterday Analysis Bulls above 8723 can see move till 8851/8900, bears below 8577 can see move till 8520/8484. Its been 22 days we have traded in range of 204 points 8517-8721, suggesting market is seeing time correction frustrating traders and hitting SL, traders who survive this phase by applying risk and money management are rewarded handsomely in the next move .Low made today was 8583 near our important gann level of 8577 which we have discussed many time in our past analysis High made today was 8683 so bulls need to wait for break of 8711-8723 range for further upmove. Will Bank Nifty break 19158 or 19367 for next move ?

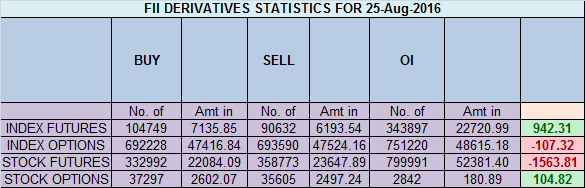

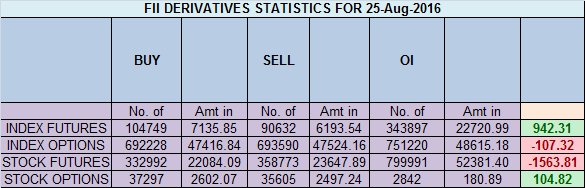

- Nifty September Future Open Interest Volume is at 2.63 core with addition of 50 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @8686, total rollover coming @81%, Highest of 2016.

- Total Future & Option trading volume was at 4.51 Lakh core with total contract traded at 1.5 lakh , PCR @0.93 , Trader’s Resolutions for the New Financial Year 2016-17

- FII’s sold 372 cores in Equity and DII’s sold 357 cores in cash segment.INR closed at 67.05

- Nifty Futures Trend Deciding level is 8685 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8685 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8621 Tgt 8650,8677 and 8720 (Nifty Spot Levels)

Sell below 8577 Tgt 8555,8520 and 8484 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Hi Bramesh ji,

Can you pls explain how the rollover cost is calculated ?

Thanks

Athi