Voltas

Positional Traders can use the below mentioned levels

Close above 364 Tgt 372/377

Intraday Traders can use the below mentioned levels

Buy above 363 Tgt 366,370 and 373 SL 361

Sell below 356 Tgt 352.8,350 and 345 SL 360

CESC

Positional Traders can use the below mentioned levels

Close above 640 Tgt 664

Intraday Traders can use the below mentioned levels

Buy above 631 Tgt 636,642 and 651 SL 628

Sell below 626 Tgt 622,615 and 607 SL 629

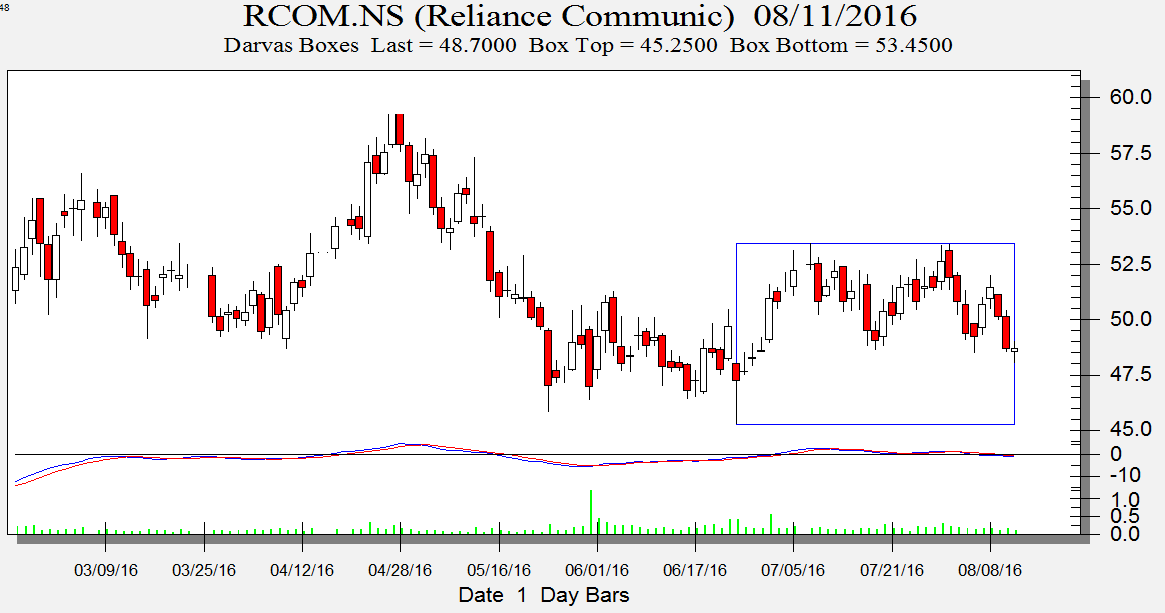

RCOM

Positional Traders can use the below mentioned levels

Close above 50 Tgt 52/54

Intraday Traders can use the below mentioned levels

Buy above 49.2 Tgt 49.5,51 and 52 SL 48.8

Sell below 48 Tgt 47.5,47 and 46.2 SL 48.4

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for July Month, Intraday Profit of 3.57 Lakh and Positional Profit of 4.79 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

Sir

Thanx for reply n advice . I am happy that am learning from my mistakes that is only possible through you bramesh sir. keep going ..

Dear sir,

Please advise the fair price for purchasing Hindalco and Cummins Ind share.

Regards

Vandana Yadav

hello sir

i have started trading from really account from 20 days with 1 lac capital. I follow risk managemnt with 1% per trade n i follow your call levels for intrday trading but in these 20 days of trading I told 1 position where risk was not defined i end up losing 20% of captial.. now i need to come back … i need your advise to handle this…

thanks

Dear Hitesh,

Its 20% of trade which make 80% of money or lose 80% of money..

In your case 1 trade which gave you big loss.. Learn from your mistake and avoid doing this going forward..