- FII’s bought 9.8 K contract of Index Future worth 631 cores ,9 K Long contract were added by FII’s and 0.8 K short contracts were liquidated by FII’s. Net Open Interest increased by 8.2 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures. Tested Classic Stock Trading Rules-I

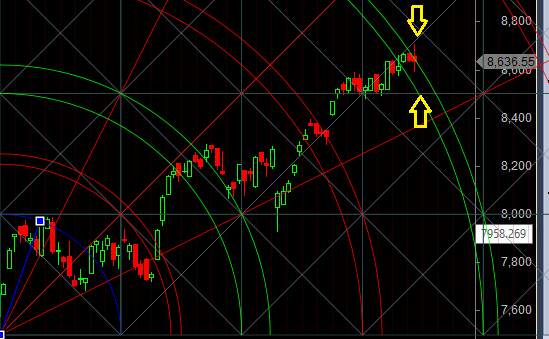

- As discussed in Yesterday Analysis Now the zone of 8654-8677 is crucial supply zone, closing above 8677 level again can see fast move till 8849. High made today was 8711 but again market failed to close above 8677, Low made was 8590 where bears were also unable to break 8577, Thats the reason we always tell traders to prepare both side plan and never go for directional move till we close above certain important levels.Close above 8677 Nifty can make next move till 8800/8951. Bearish only on close below 8490 and bullish on close above 8677 in between yo-yo move.Bank Nifty does 18700 below 18950, EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.25 core with addition of 3.4 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @8650 closed above it

- Total Future & Option trading volume was at 2.91 Lakh core with total contract traded at 1.61 lakh , PCR @0.88 , Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 36.7 lakh, resistance at 8800 .8500/9000 CE added 16.1 lakh so resistance formation in 8800-8900 .FII bought 8.8 K CE longs and 9.8 K CE were shorted by them .Retail bought 82.8 K CE contracts and 64.6 K CE were shorted by them.

- 8500 PE OI@43.5 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 148.3 Lakh in OI so bulls making strong base near 8500-8550 zone .FII bought 19.6 K PE longs and 8.7 K PE were shorted by them .Retail bought 23.6 K PE contracts and 23.7 K PE were shorted by them.

- FII’s bought 726 cores in Equity and DII’s sold 413 cores in cash segment.INR closed at 66.74

- Nifty Futures Trend Deciding level is 8690 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8688 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8650 Tgt 8680,8711 and 8750 (Nifty Spot Levels)

Sell below 8620 Tgt 8595,8572 and 8550 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Thank you SIr..for showing us the right trading approach

thanks a lot happy to help..

Some action seen in nifty 8000PE on Friday. What’s your say Bramesh Ji. As I remember similar action was seen in Jan 2011 in 5700 and 5300 Pe when nifty was trading at about 6150. Kindly analyse 8000 Pe Action.

Dear Sir,

What is going to happen I am least bothered about, As a trader money is made when we follow plan, MY plan is simple no longs below 8577.. Follow price action closely you will follow what smart money is doing..

Sir, Highest OI is showing @ 9000…..please let us the reason for you to mention @8800

8800 is nearest resistance so we take that..

Sir .All learning from you .You r great yet humble in teaching !!! Kudos as always to you .