- FII’s sold 8.2 K contract of Index Future worth 480 cores ,4.2 K Long contract were liquidated by FII’s and 4 K short contracts were added by FII’s. Net Open Interest decreased by 228 contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures.Struggle is Good!

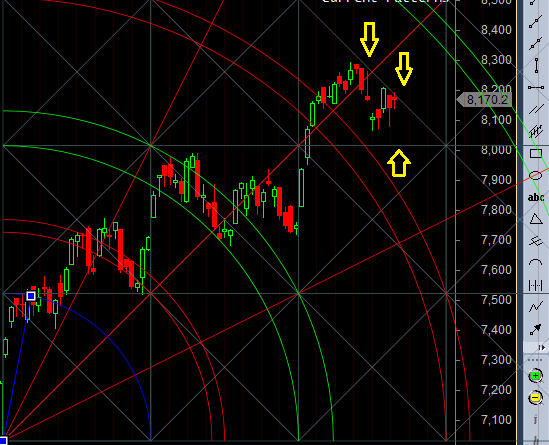

- As discussed in Yesterday Analysis Now bulls need to close above 8210 for this upmove to continue as its near the falling horizontal gann line. Failing to close above 8210 can again see downmove towards 8120/8029 High made today was 8195 and low made was 8135 so we did not break 8210 and also second week we closed below 8210, Now if we break 8135 we can see fast move towards 8070/802987980 . Bullish only on close above 8210 Bank Nifty Bulls continue to hold 17666 ,EOD Analysis

- Nifty June Future Open Interest Volume is at 1.70 core with addition of 0.02Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 2.27 Lakh core with total contract traded at 1.52 lakh , PCR @0.95, Trader’s Resolutions for the New Financial Year 2016-17

- 8300 CE is having Highest OI at 65.1 lakh, resistance at 8300 .8300/8600 CE added 6.7 lakh so bears forming resistance at higher levels 8300-8400 zone .FII bought 1.9 K CE longs and 16.3 K CE were shorted by them .Retail bought 27.6 K CE contracts and 10.2 K CE were shorted by them.

- 8000 PE OI@78.9 lakhs having the highest OI strong support at 8000. 8000-8600 PE added 8.5 Lakh in OI so bulls making strong base near 8000 zone .FII bought 11.5 K PE longs and 6.5 K PE were shorted by them .Retail bought 27.1 K PE contracts and 20.9 K shorted PE were covered by them.

- FII’s bought 31 cores in Equity and DII’s sold 26 cores in cash segment.INR closed at 67.07

- Nifty Futures Trend Deciding level is 8185 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8187 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8175 Tgt 8200,8225 and 8250 (Nifty Spot Levels)

Sell below 8130 Tgt 8110,8080 and 8050 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Bramesh, you mentioned that .”Retail bought 27.1 K PE contracts and 20.9 K shorted PE were covered by them.”. Am finding the first part correct but 20.9 K PE have been shorted and not covered. Please clarify. Thanks

hello sir

Just need one clarification

what is meaning of heavy put writing going on ?

If it mean people are selling puts, then selling quantity volume (TSQ) of puts should be more than buying quantity, TBQ of puts of any strike level.

These is no thumb rule like this ..