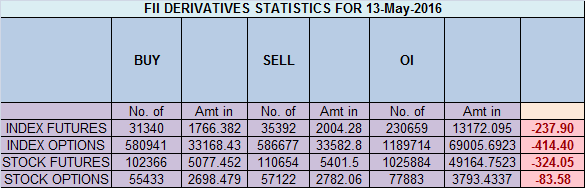

- FII’s sold 4 K contract of Index Future worth 237 cores ,6.5 K Long contract were liquidated by FII’s and 2.5 K short contracts were liquidated by FII’s. Net Open Interest increased by 9.1 K contract, so fall in market was used by FII’s to exit long and exit shorts in Index futures.Cella Quinn from Dishwasher to President of Investment Firm

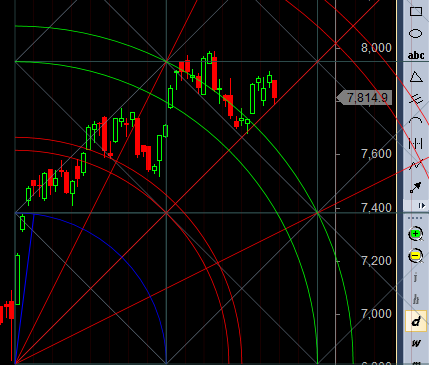

- As discussed in last analysis As I have been seeing we are seeing time correction On 02 May nifty closed at 7800 and today 12 May closed at 7900, so in 9 trading session we moved just 100 points, this is time correction trading in a range and eating premium of options. Nifty closed today was 7814 so move just 14 points in 11 trading session, time correction happening but frustrating lot of traders with whipsaws. Low made today was 7784, highlighting the importance of 7777 and closed above 7800 but below 7850, so market closed at no trade zone, Also we are near the gann trendline as shown below, holding the same we can see bounce back. This is the time when market rewards “UNDISCIPLINED” Traders who do not put SL when position goes against them and to see their prices coming back the next day, but this attitude of being undisciplined trading will prove fatal when we get trending move, Part Booking can only save traders in such market. Bank Nifty nearing 17000,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.62 core with liquidation of 7.5 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7953, continue to trade below it.

- Total Future & Option trading volume was at 2.90 Lakh core with total contract traded at 2.1 lakh , PCR @0.95, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 85.5 lakh, resistance at 8000 .7500/8000 CE added 36 lakh so bears added aggressively at 8000 CE .FII sold 2.1 K CE longs and 18.3 K CE were shorted by them .Retail bought 84 K CE contracts and 12.7 K CE were shorted by them.

- 7700 PE OI@50.8 lakhs having the highest OI strong support at 7700. 7200-7700 PE liquidated 13.4 Lakh in OI so strong base near 7500-7600 zone .FII bought 17.4 K PE longs and 2.6 K PE were shorted by them .Retail sold 56 K PE contracts and 12.1 K shorted PE were covered by them.

- FII’s bought 1493 cores in Equity and DII’s bought 667 cores in cash segment.INR closed at 66.61

- Nifty Futures Trend Deciding level is 7830 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7845 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7830 Tgt 7850,7870 and 7900 (Nifty Spot Levels)

Sell below 7770 Tgt 7750,7730 and 7690 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Sir I have been asking since long about the stop losses for chopad levels or the technique to play it. I will be highly obliged.

Dear Sir,

I have already explained in many of my comments. Please have a look..

Rgds,

Bramesh

SIRR I HAVE 7800CE AT105 CAN I HOLD?

exit if close below 7777

Sir

As nifty is in the support of 200 dma,and gunner chart support gann trend line looks like china wall protection. Breaking both looks like disastrous.Can I initiate fresh short below gann trend line.? If it close below 200 dma

Plan your trade and trade your plan

I have banknifty16800ce@233….can I expect banknifty 17200 by expiry

exit if close below 16500

Sir , can we expect 8200 in June ?

7972 holds the key…