Last Week we gave Chopad Levels of 7246 , Nifty gave short entry on Monday and did all 3 targets on downside by Tuesday Budget day panic low and gave long entry on Budget Day @ 7058 and did all 4 target on upside rewarding discipline chopad followers by 500 points. Low made of 6825 was near our Chopad target of 6825. Lets analyses how to trade nifty next week after the big rally of 6.5%

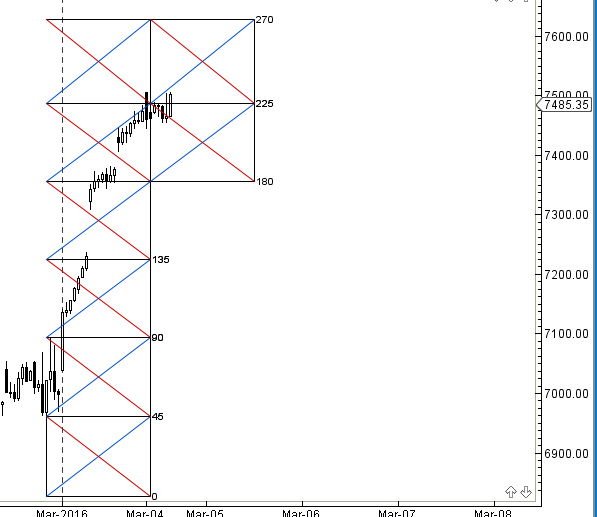

Nifty Hourly Chart

Holding 225 degree Nifty cam move towards 7631,below 225 degree we can see correction till 7357.

Nifty Harmonic

Now we have probable BAT pattern forming on Nifty, Pattern BC leg will complete around 6916-6900 range if held on closing basis we can see move till 7250/7459.

BAT Pattern was a good trade, till we close above 7460 we can see next move till 7590/7790 for completing of BAT pattern.

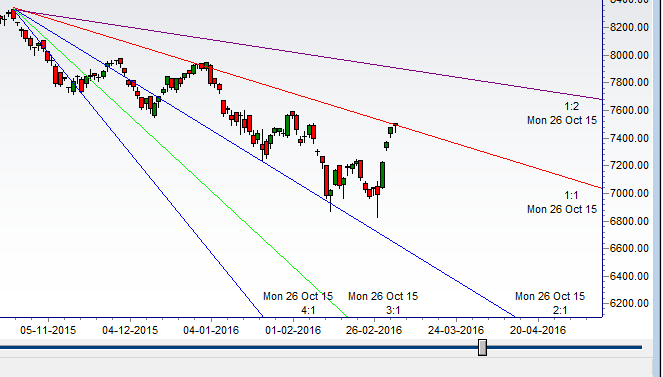

Nifty Gann Angles

Gann Angles also suggest a move till 7400

Now Nifty need to close above 7512 for next move 7650/7700.

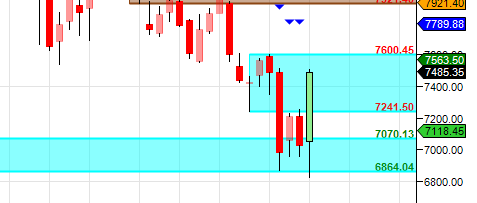

Nifty Supply and Demand

As discussed last week Close above 7242 om Weekly basis can target 7600. Nifty almost did 7505.

Nifty Gann Date

Nifty As per time analysis 10 March is Gann Turn date , except a impulsive around this dates. Last week we gave 29 Feb/04 March Nifty saw a volatile move.

Nifty Gaps

For Nifty traders who follow gap trading there are 6 trade gaps in the range of 7000-9000, rest all gaps were filled in the last week fall.

- 7109-7090

- 7235-7308

- 7368-7406

- 7387-7275

- 7298-7271

- 8937-8891

- 8251-8241

- 8232-8209

- 8116-8130

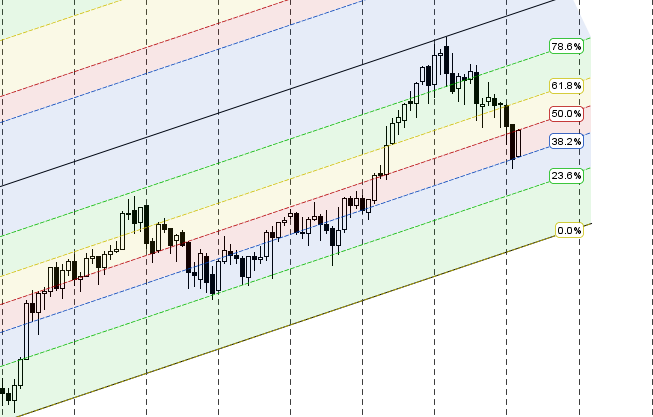

Fibonacci technique

Fibonacci Fan

7707/7527/7400/7273 levels to be watched in coming week.

Nifty Weekly Chart

It was positive week, with the Nifty up by 455 points closing @7485 reacted from gann support of 7830, and closing near the middle line of channel resistance and above its 200 WSMA, As discussed last week Now close above 7232 can see nifty moving to 7500-7600 range and break of 6860 can see move towards 6660. Nifty did 7500, Now coming week Nifty needs to hold 7390-7380 range for next move towards 7600/7700.

Trading Monthly charts

Monthly chart bounced from 38.2% support.

Nifty PE

Nifty PE @20.24

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:7512

Nifty Resistance :7587,7636,7716

Nifty Support :7457,7392,7300

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Sir , how do u define a TRENDING or SIDEWAYS market…. Plz guide.

Regards ,

Devinder.

Higher High Higher low See Hourly chart of 1 march

Sideways See Hourly chart of 04 March

BEST CHOPAD PERFORMANCE

Good report

Hi Bro,

I have been following your blog over 6 months and found it very useful. I have a query though for your analysis on Nifty for coming week. On the expected BAT (bearish after leg CD) pattern of Gartley, how are you confirming this as a BAT.

Typically the leg BC should be either .382 or .886 retracement of move AB. If we considered point A formed on 12th Feb and point C on 25th Feb if I see your chart. But here it is almost 100% retracement, not 88% of AB. Can you please confirm if my finding is correct or you are being flexible with 12% extra to plot C.

P.S – This is not to challenge your analysis, but to confirm my finding or to understand if I am going wrong, Hope you will answer.

Regards,

Anid

Deat Anid,

Basic Difference in BAT and Gartley is the XB leg (0.618 is Gartley and 0.382-.050 in BAT) and BD leg.

Let me know if you have any questions.

Rgds,

Bramesh