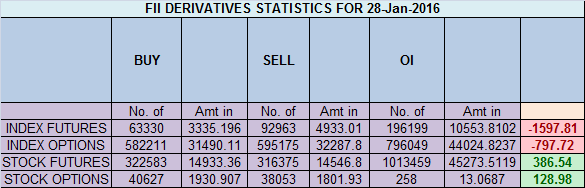

- FII’s sold 29.6 K contract of Index Future worth 1597 cores ,103 K Long contract were Liquidated by FII’s and 57.7 K short contracts were liquidated by FII’s. Net Open Interest decreased by 161 K contract, so fall in market was used by FII’s to exit long and exit shorts in Index futures. Using Your Intuition in trading

- As discussed in Last Analysis Now range of 7460-7480 should be watched closely as closing above it can see nifty moving in 7550-7575 range where we have strong supply, Support at 7320 and 7250. High made was 7468 and nifty came down to close @7424. We need a close above 7462 for market to reach the next target of ABCD pattern @ 7521. Support at 7366/7241 near gann arc as shown in below chart Bank Nifty Feb Series Analysis

- Nifty February Future Open Interest Volume is at 1.88 core with addition of 39.2 Lakh with decrease in cost of carry, Rollovers comes @67.3% and rollover cost @7419

- Total Future & Option trading volume was at 5.35 Lakh core with total contract traded at 1.80 lakh , PCR @1.03 .How To Identify Market Tops and Bottom

- 7500 CE OI at 32 lakh , wall of resistance @ 7500 followed by 7600 CE.

- 7200 PE OI@32.7 lakhs strong base @ 7200. Range for Feb series as per Option data comes in range of 7200-7800.

- FII’s sold 961 cores in Equity and DII’s bought 395 cores in cash segment.INR closed at 68.22

- Nifty Futures Trend Deciding level is 7451 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7451 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7450 Tgt 7475,7500 and 7521 (Nifty Spot Levels)

Sell below 7400 Tgt 7375,7340 and 7310 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Nice Sir!

TDL & TCL – 7451– ARE THEY SAME?

Yes Sir

What are StopLoss levels for Nifty/BankNifty

20 Points for Nifty and 50 Points for BN