- FII’s bought 6.3K contract of Index Future worth 329 cores ,6.9 K Long contract were added by FII’s and 575 short contracts were added by FII’s. Net Open Interest increased by 7.5 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. Do you have what it takes to be a trader?

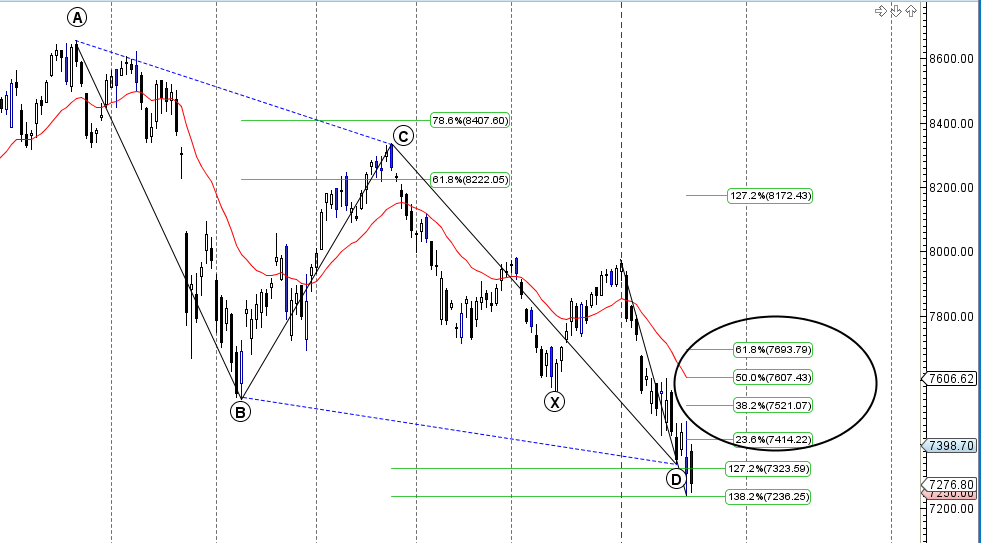

- Nifty again bounced from 7250 level near the ABCD pattern completion as it touched 138.2% retracement as we have been discussing in last analysis and bounced back almost 80 points from the low. Harmonic Pattern (We recently started Harmonic Course for traders wanting to learn more about it) gives you precise entry with minimum risk, 1 Target of rise comes at 7414 Nifty today made high of 7401 doing the 1 target and correcting back to 7250 but eventually bouncing back again. Break of 7232 will invalidate the pattern till its held we can see strong bounceback in market.Nifty now needs to close above 7336 for a quick move towards 7432 as shown in below chart. Bank Nifty hold the gann arc,EOD Analysis

- Nifty January Future Open Interest Volume is at 1.95 core with liquidation of 12.5 Lakh with increase in cost of carry suggesting short position were closed today . Nifty rollover cost 7930 close below it saw sharp decline

- Total Future & Option trading volume was at 3.98 Lakh core with total contract traded at 2.5 lakh , PCR @0.86.How To Identify Market Tops and Bottom

- 7500 CE OI at 55.3 lakh , wall of resistance @ 7500 .7400/8000 CE added 3 lakh in OI so major addition was seen by bears suggesting as nifty bounced from 7250 today we might have formed short term bottom .FII bought 2.5 K CE longs and 13.2 K CE were shorted by them .Retail bought 36.1 K CE contracts and 20.4 K CE were shorted by them.

- 7300 PE OI@61.8 lakhs strong base @ 7300. 7300/8000 PE liquidated 12 lakh so bulls again used to rise to exit as nifty did not close above previous day close.FII bought 12.8 K PE longs and 4 K PE were shorted by them .Retail bought 10.9 K PE contracts and 16.8 K PE were shorted by them.

- FII’s sold 1747 cores in Equity and DII’s bought 1267 cores in cash segment.INR closed at 68.02

- Nifty Futures Trend Deciding level is 7316 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7391 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7340 Tgt 7367,7401 and 7440 (Nifty Spot Levels)

Sell below 7300 Tgt 7280,7250 and 7200 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Nice gud analysis sir on 21 Jan nifty which same reflect on 22 Jan gud one

Can you please check levels again. Nifty clise is 7276