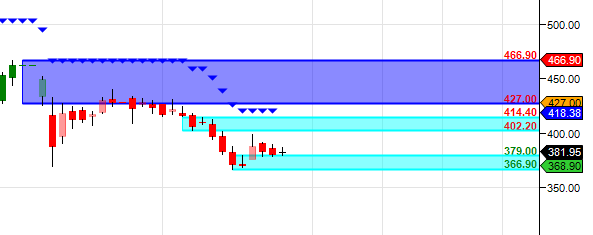

KSCL

Positional/Swing Traders can use the below mentioned levels

Close below 379 target 366

Intraday Traders can use the below mentioned levels

Buy above 383 Tgt 386,390 and 393 SL 381

Sell below 378.4 Tgt 375.2,371 and 368 SL 381

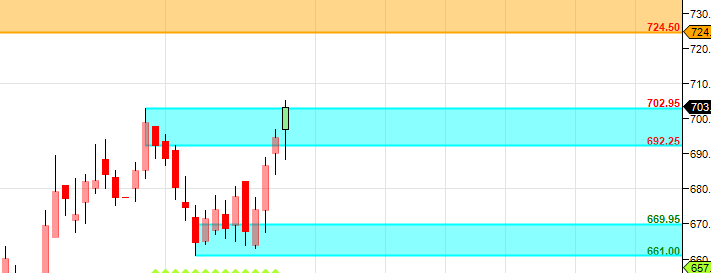

Kotak Bank

Positional/Swing Traders can use the below mentioned levels

Close below 692 target 670

Intraday Traders can use the below mentioned levels

Buy above 704 Tgt 709,715 and 725 SL 698

Sell below 696 Tgt 693,684 and 676 SL 700

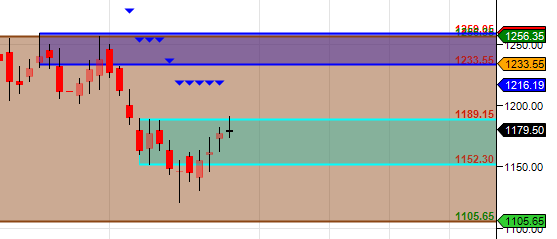

Siemens

Positional/Swing Traders can use the below mentioned levels

Close below 1174 target 1152

Intraday Traders can use the below mentioned levels

Buy above 1182 Tgt 1189,1198 and 1206 SL 1177

Sell below 1170 Tgt 1165,1155 and 1145 SL 1177

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for November Month, Intraday Profit of 4.14 Lakh and Positional Profit of 5.08 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Bramesh Sir.. from last few days the content is getting overlapped by Ads.. only top 2 stocks are visible, 3rd one is completely hidden behind some ad.

It has been rectified .. Inconvenience caused is regretted.