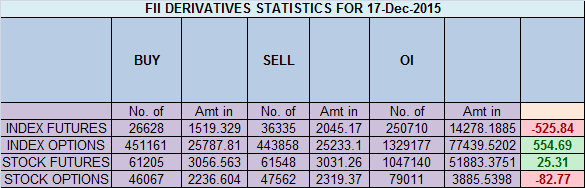

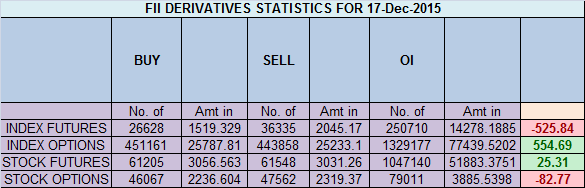

- FII’s sold 9.7 K contract of Index Future worth 525 cores ,13.3 K Long contract were liquidated by FII’s and 3.6 K short contracts were liquidated by FII’s. Net Open Interest decreased by 17 K contract, so today’s rise in market was used by FII’s to exit long and exit shorts in Index futures. How to Handle Trading Loss ?

- As discussed Nifty forming Bullish SHARK pattern its PRZ is near 7550, so price action near 7539/7550 needs to be watched to check the validity of this pattern, Nifty made low of 7551 and rallied almost 300 point from the low, and achieved 3 target of SHARK pattern and also stopped near the gunner line as mentioned in below post, As soon as nifty sustained above 7767 we saw a fast and furious move towards 7853, which is near the supply zone of 7858, Bulls need to close above 7858 for next move towards 7979 else market can come down to retest 7767 where price action needs to be seen . Bank Nifty near supply zone,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.90 core with liquidation of 4.5 Lakh with decrease in CoC suggesting long position were closed today. Nifty closing below rollover cost 7896.

- Total Future & Option trading volume was at 2.89 Lakh core with total contract traded at 1.8 lakh , PCR @0.92.VIX fall after the FED Event is over so OTM Option Buyers saw premium crashing.

- 8000 CE OI at 77.9 lakh , wall of resistance @ 8000 .7600/8000 CE liquidated 25.2 lakh in OI as bears covered aggressively in 7800/8000 CE.FII sold 0.08 K CE longs and 29.7 K shorted CE were covered by them .Retail sold 17.9 K CE contracts and 17 CE were shorted by them.Retailer went with bearish bias in the event and market rallied.

- 7500 PE OI@57 lakhs strong base @ 7500. 7600/8000 PE added 18 lakh so bulls added on 7600/7700.FII sold 27.8 K PE longs and 6.2 K shorted PE were covered by them .Retail bought 1.2 K PE contracts and 20.9 K PE were shorted by them.

- FII’s bought 638 cores in Equity and DII’s sold 366 cores in cash segment.INR closed at 66.42.

- Nifty Futures Trend Deciding level is 7805 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7813 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7810 Tgt 7840,7870 and 7900 (Nifty Spot Levels)

Sell below 7770 Tgt 7740,7715 and 7695 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

THANS SIR

sir what is nifty target for Monday / tuesday

Sir, do you provide nifty info on daily basis ? What is the service and its charges??

We do not charge anything.Updates are avilable free of cost

Sir I think Nifty levels are of yesterday’s.

They are perfect

Ya, since a few days, some of the posts are not coming the same day.Like this post was meant to be posted on 17th evening but was posted on 18th. Hence the confusion.

It would be great if the heading indicated which for which date is the analysis done.

Please Like my facebook page https://www.facebook.com/Brameshs-Tech-140117182685863/

As soon as Post is updated Facebook page is updated.

Rgds,

Bramesh