DISH TV

Positional/Swing Traders can use the below mentioned levels

Close above 94 target 97/101

Intraday Traders can use the below mentioned levels

Buy above 94 Tgt 95,96.5 and 98 SL 93.5

Sell below 93 Tgt 92,90.5 and 89 SL 93.5

SKS Micro

Positional/Swing Traders can use the below mentioned levels

Close below 466 target 442

Intraday Traders can use the below mentioned levels

Buy above 470 Tgt 474,482 and 487 SL 466

Sell below 461 Tgt 457,453 and 449 SL 464

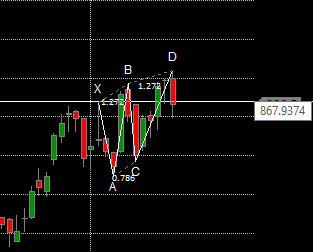

Asian Paint

Intraday Traders can use the below mentioned levels

Buy above 870 Tgt 880,890 and 900 SL 866

Sell below 859 Tgt 855,846 and 830 SL 865

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for November Month, Intraday Profit of 4.14 Lakh and Positional Profit of 5.08 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Dear Ramesh Ji…

I started following your views letter and spirit and Looks Very Interesting.. Thank you so much for the same. I have a small clarification on Positional Levels..

Example…We use today’s dish TV call..

Positional/Swing Traders can use the below mentioned levels

Close above 94 target 97/101

What is the SL for above call? Please guide me to set SL as that ultimate for every trade.

Please read this http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/

Rgds,

Bramesh